WCF Advisors Blog

Helping to preserve a bank’s legacy and its future

Feb 05, 2024

|

Client Success Stories

After John Connolly — the much-loved president of a fourth-generation, family-owned community bank in western Minnesota — suddenly passed away in 2020, the shareholders and management of West 12 Bancorporation and its wholly owned bank subsidiary, State Bank of Danvers, revisited its strategic plan. They ultimately determined the 121-year-old institution would need to acquire or be acquired to keep up with the ever-changing financial landscape.

Challenge

With shareholders and...

2022 M&A year in review

Jan 27, 2023

|

Client Success Stories

Wipfli Corporate Finance Advisors, the investment banking and corporate finance arm of Wipfli, experienced a solid year, completing four sell-side M&A transactions across a range of industries. The firm provided custom-tailored solutions to each of its clients to successfully identify and execute on optimal transaction structures and terms, resulting in positive outcomes for all parties involved in each transaction. Wipfli Corporate Finance is proud to have served its clients in 2022 and is...

Amperage Electrical Supply, Inc. acquired by Consolidated Electrical Distributors

Jan 27, 2023

|

Client Success Stories

Positioning for an even brighter future

Vito Pelagio was facing a big decision as he weighed the future of Amperage Electrical Supply, Inc., the business he built and grew as sole owner for 25 years. He had taken the company as far as he believed he could since 1997, with sales rising from $3 million in its first year to more than $110 million in 2022, and his number of employees growing from five to 115.

While forever grateful to his mother for helping him secure his first bank loan when he was...

2022 Q2 M&A activity update

Sep 28, 2022

|

Market Updates

Merger & acquisition activity(1)

The 2022 global M&A continues to slow down from a busy latter half of 2021, with Q2 2022 deal count lagging behind the same period in 2021.

Pitchbook reports that the North American deal market closed 3,030 deals worth a combined $544.3 billion, a decline of 20% and 18% respectively.

M&A activity faced some major headwinds this quarter, including geopolitical tension and supply chain uncertainty brought about from the COVID-19 pandemic.

Macroeconomic...

2022 Q1 M&A activity update

Aug 05, 2022

|

Market Updates

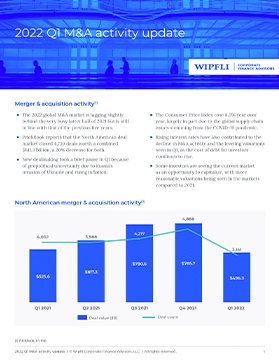

M&A activity(1)

The 2022 global M&A market is lagging slightly behind the very busy latter half of 2021 but is still in line with that of the previous five years.

PitchBook reports that the North American deal market closed 4,739 deals worth a combined $611.3 billion, a 20% decrease for both.

New dealmaking took a brief pause in Q1 because of geopolitical uncertainty due to Russia’s invasion of Ukraine and rising inflation.

The Consumer Price Index rose 8.5% year over year,...

M&A deal activity continues to reach record highs in Q4 2021

Mar 28, 2022

|

Market Updates

Deal activity in the fourth quarter of 2021 continued its record-setting pace as seen in the previous three quarters, driven by the continued economic recovery, favorable cost of debt, high levels of dry powder and strengthening job market. Favorable stock prices and relatively low borrowing costs spurred buyers.

The robust activity is expected to continue in 2022 amidst new challenges and uncertainty. Investors’ concerns regarding interest rate have heightened, as the Fed has signaled...

Closet Works’ $21.5 million sale to The Container Store

Mar 08, 2022

|

Client Success Stories

Home improvement frenzy creates prime selling opportunity for business owners

When Frank and Tom Happ were ready to sell Closet Works, the Chicago-based company they had bought and transformed over the prior nine years, business was surging. Amid the COVID-19 pandemic, people had hunkered down to create or improve their home organization systems — including closets, pantries, offices, mudrooms and garages — during the home-buying frenzy.

There quickly proved to be a lot of interest...

M&A market experiences record deal activity in Q3 2021

Dec 14, 2021

|

Market Updates

Deal activity in the third quarter of 2021 continued its record-setting pace. As seen in the previous two quarters, it was driven by the continued economic recovery, favorable cost of debt, high levels of dry powder and strengthening job market.

The fourth quarter of 2021 is expected to see a record level of M&A volume ahead of the potential capital gains tax change. Looking forward, 2022 is poised for another strong year of M&A, with private equity firms sitting on an unprecedented...

M&A market heats up in Q2 2021

Sep 08, 2021

|

Market Updates

Deal activity in the second quarter of 2021 continued at the feverish pace seen in the previous two quarters, driven by the continued economic recovery, favorable cost of debt, high levels of dry powder and a strengthening job market.

The continued economic recovery has driven valuation multiples back toward prepandemic levels. As the vaccinated population increases and consumer sentiment continues to improve, the M&A market — as well as the economy as a whole — experienced...

M&A market continues rebound in Q1 2021

Jun 11, 2021

|

Market Updates

Through the first quarter of 2021, the global economy and the M&A landscape continued to show signs of recovery.

Several months of pent-up seller interest led the charge in an uptick in deal volume toward the end of 2020, with valuation multiples making their way back toward pre-pandemic levels. Successful vaccine rollouts, relaxed COVID-19 restrictions, improved consumer sentiment and a strengthening job market have contributed to recent economic and M&A market rebounds.

While M&A...

Looking to be more acquisitive?

Having an acquisition plan is critical. Start yours now.

Get the checklist now

Categories

All Categories

Read all Market Updates and Insights

Market Updates

A quarterly, insightful look at middle-market merger and acquisition activity.

Market Insights

Thought-provoking articles on value, growth, and strategy, merger and acquisition news, research and analysis from WCF consultants.

Client Success Stories

See how WCF has earned our clients’ confidence with strategic and transactional support and guidance.