M&A market experiences record deal activity in Q3 2021

Deal activity in the third quarter of 2021 continued its record-setting pace. As seen in the previous two quarters, it was driven by the continued economic recovery, favorable cost of debt, high levels of dry powder and strengthening job market.

The fourth quarter of 2021 is expected to see a record level of M&A volume ahead of the potential capital gains tax change. Looking forward, 2022 is poised for another strong year of M&A, with private equity firms sitting on an unprecedented amount of dry power.

M&A activity

The economic recovery coming out of the COVID-19 pandemic is fueling unprecedented M&A activity. In addition, strong stock prices, ample cash on corporate balance sheets, and cheap financing will likely continue this momentum into the coming quarters.

Economic uncertainty continues to diminish, resulting in executives feeling more confident and willing to pursue more sizable M&A deals than a year ago.

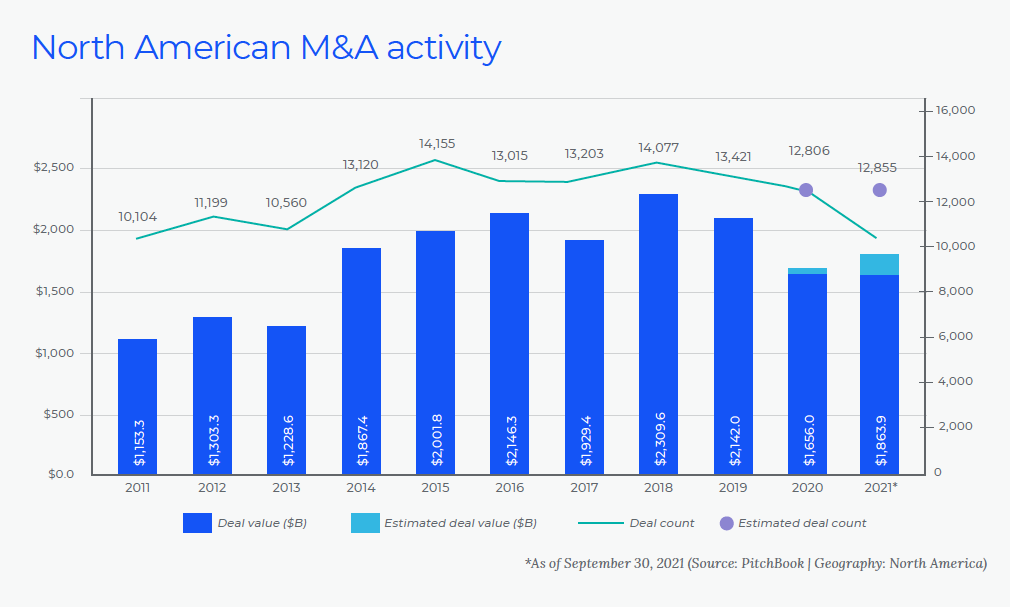

PitchBook reports that the North American deal market closed 4,609 deals in Q3 2021, accounting for $708.3 billion in value. Deal count and value are on track to exceed the previous annual record.

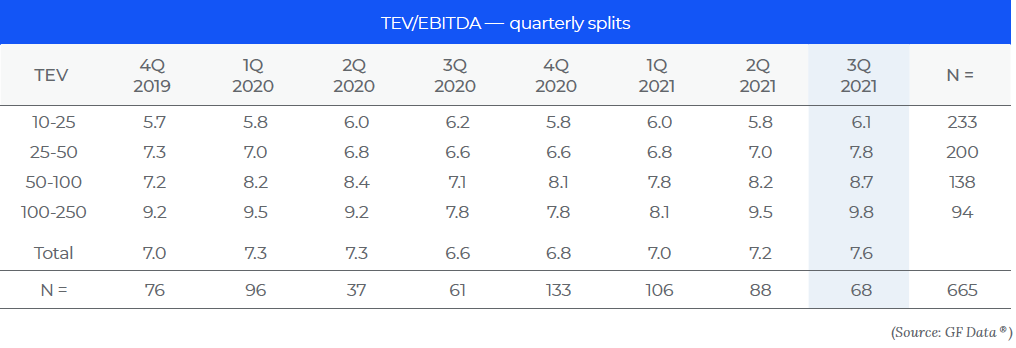

In aggregate, middle-market valuations rose steadily from 7.2x EBITDA in Q2 2021 to 7.6x EBITDA in Q3 2021, as reported by GF Data in its quarterly M&A report. The valuation increase between Q2 and Q3 was primarily led by the $25-$50 million enterprise value range, increasing from 7.0x EBITDA to 7.8x EBITDA. Furthermore, all enterprise value ranges increased between the two quarters.

Consistent with previous quarters, size continued to be a significant driver of valuation. Transactions in the $10-$25 million range averaged a 6.1x EBITDA multiple, and deals in the $100-$250 million range averaged a multiple of 9.8x in Q3 2021.

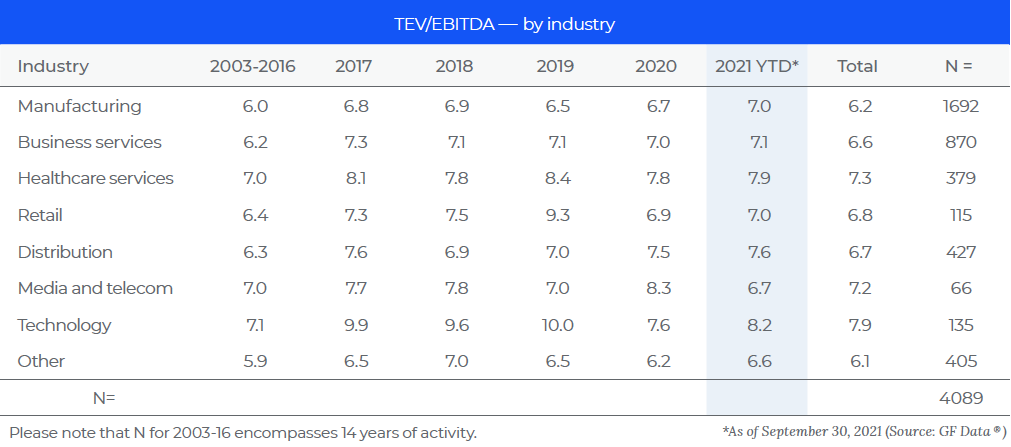

Four business categories — manufacturing, business services, healthcare services and distribution — accounted for over 80% of deal volume for YTD 2021, with valuation multiples ranging from 6.6x to 8.2x EBITDA.

Four business categories — manufacturing, business services, healthcare services and distribution — accounted for over 80% of deal volume for YTD 2021, with valuation multiples ranging from 6.6x to 8.2x EBITDA.

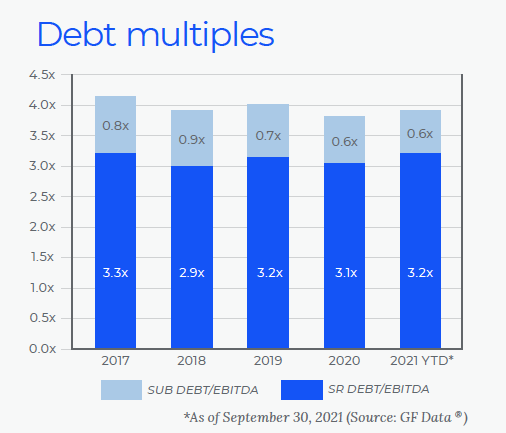

Total debt multiples have been steadily rising since the beginning of the COVID-19 pandemic, increasing from 3.6x EBITDA in Q2 2021 to 4.1x EBITDA in Q3 2021. The sharp quarter-over-quarter increase can be attributed to the stabilization of debt at elevated levels, the reemergence of junior capital and the reassertion of platform acquisitions. This increasing trend is consistent with senior debt multiples, which are up from 2.7x EBITDA in Q3 2020 to 3.1x EBITDA in Q3 2021.

In Q1 2021 and Q2 2021, subordinated debt expanded over half a turn of average capital structure. This trend has continued into Q3 2021, as subordinated debt now accounts for 1.0x of the typical capital structure.

Continuing to navigate the pandemic

While the path to recovery was looking increasingly clear, there is still uncertainty in the market with the emergence of new COVID-19 variants. As evidenced by the increase in deal volume in Q3 2021, new deals are still getting done despite the uncertainties in the marketplace, and both corporates and sponsors continue to aggressively pursue acquisition opportunities.

Wipfli Corporate Finance Advisors anticipates that valuations and deal activity will continue to steadily rise as we move through Q4 2021. With that in mind, preparation for sale should begin now. Buyers will look through the financial impact of COVID-19 and will focus on the ability to rebound. Additionally, buyers will become more aggressive as levels of dry powder remain at all-time highs. Markets are working towards an equilibrium, and a new “normal” is beginning to emerge. WCF stands by, ready to help clients navigate this turbulence.

Looking to be more acquisitive?

Having an acquisition plan is critical. Start yours now.

Get the checklist now

Categories

Read all Market Updates and Insights

A quarterly, insightful look at middle-market merger and acquisition activity.

Thought-provoking articles on value, growth, and strategy, merger and acquisition news, research and analysis from WCF consultants.