2022 Q1 M&A activity update

M&A activity(1)

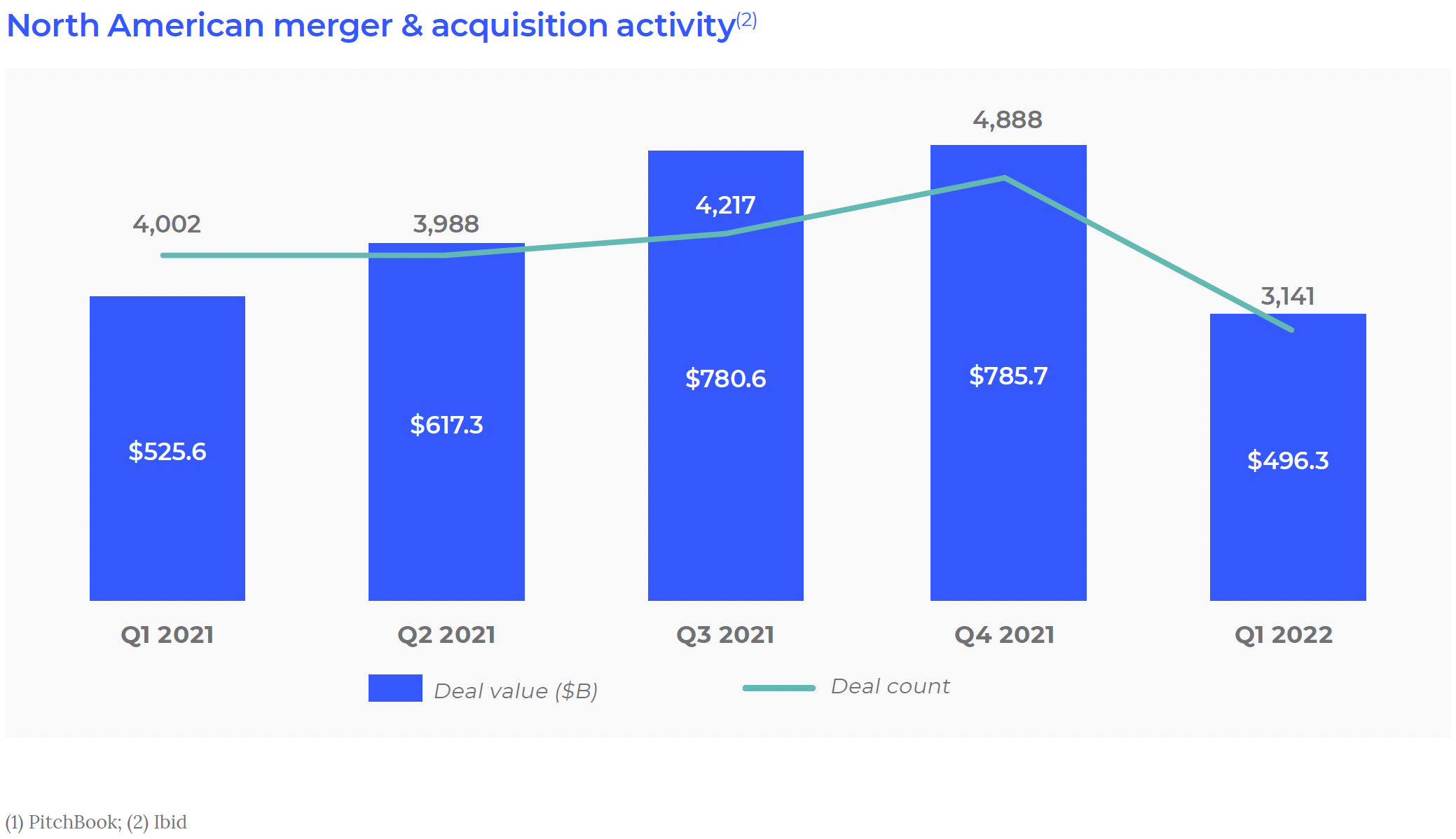

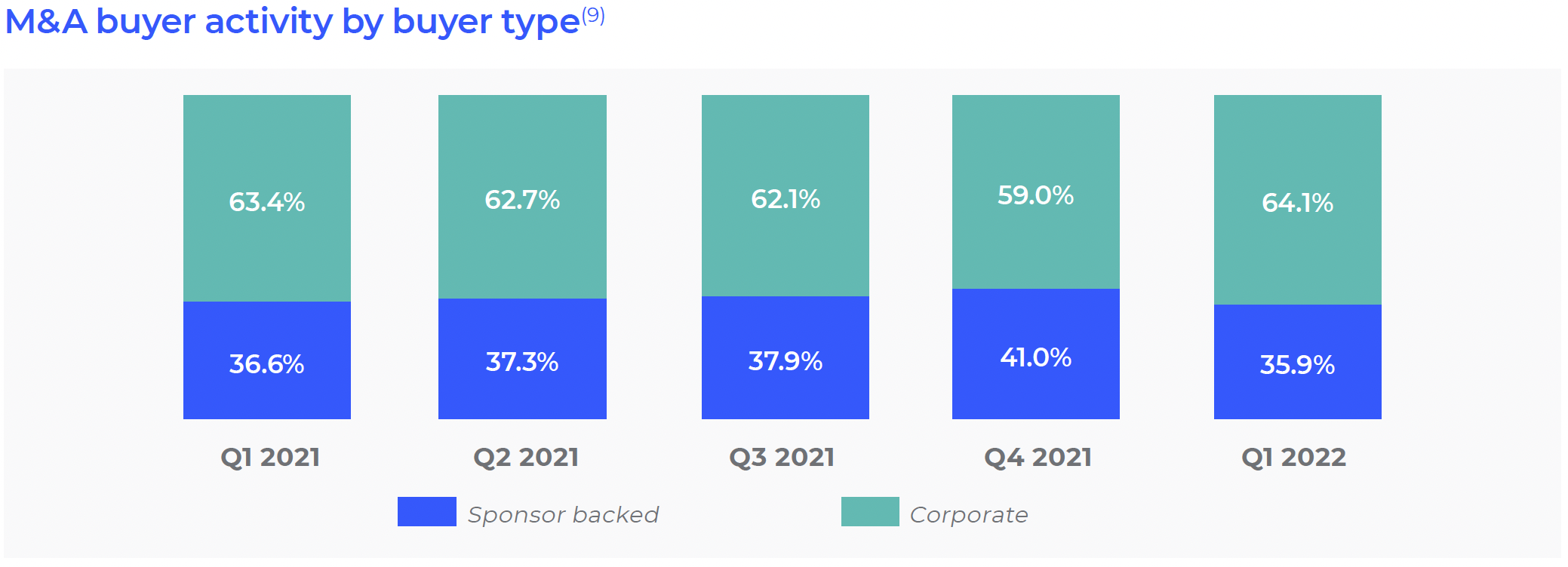

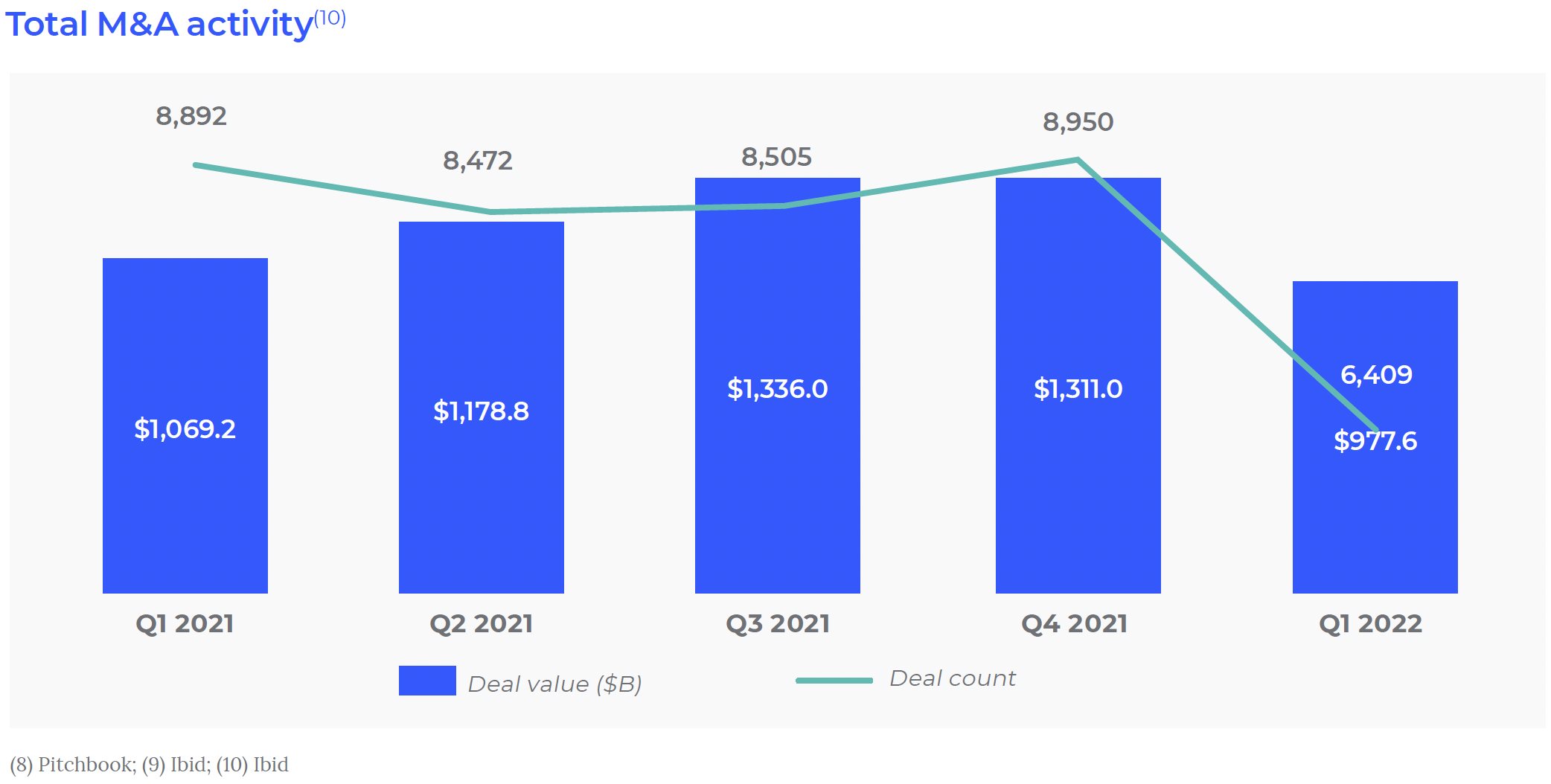

- The 2022 global M&A market is lagging slightly behind the very busy latter half of 2021 but is still in line with that of the previous five years.

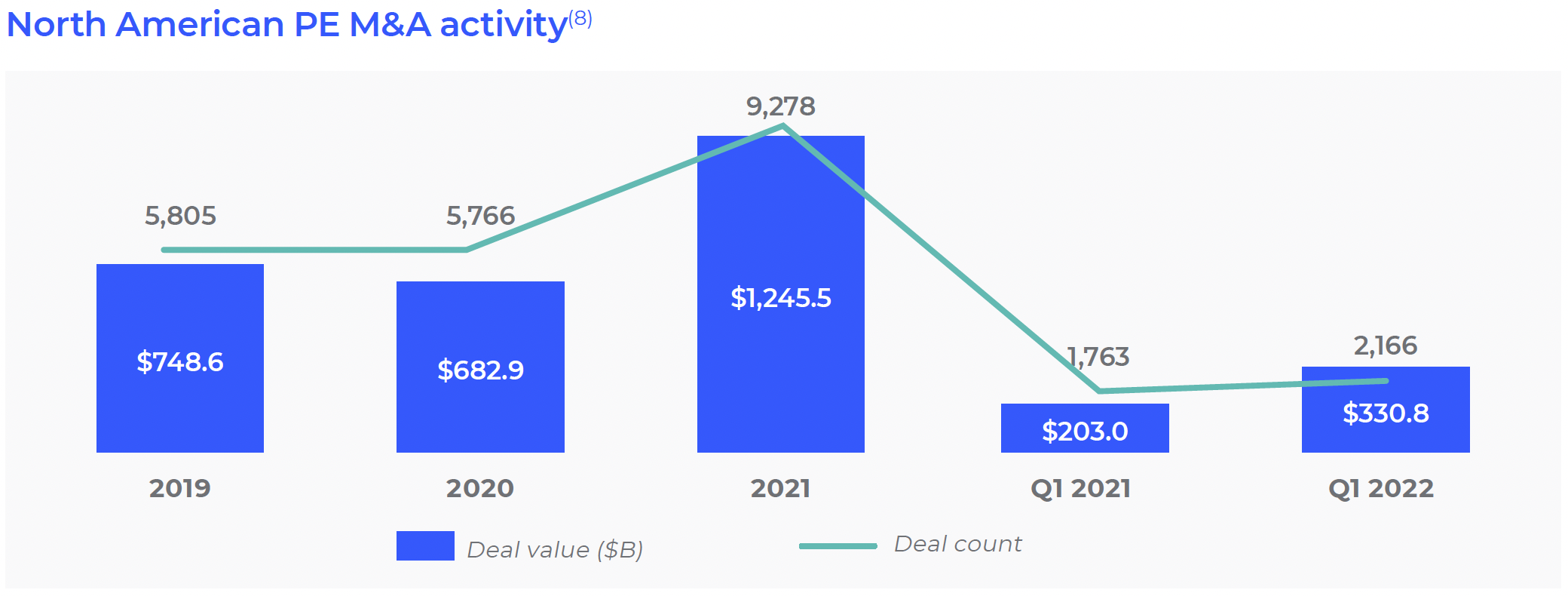

- PitchBook reports that the North American deal market closed 4,739 deals worth a combined $611.3 billion, a 20% decrease for both.

- New dealmaking took a brief pause in Q1 because of geopolitical uncertainty due to Russia’s invasion of Ukraine and rising inflation.

- The Consumer Price Index rose 8.5% year over year, largely in part due to the global supply chain issues stemming from the COVID-19 pandemic.

- Rising interest rates have also contributed to the decline in M&A activity and the leveling valuations seen in Q1, as the cost of debt for investors continues to rise.

- Some investors are seeing the current market as an opportunity to capitalize, with more reasonable valuations being seen in the markets compared to 2021.

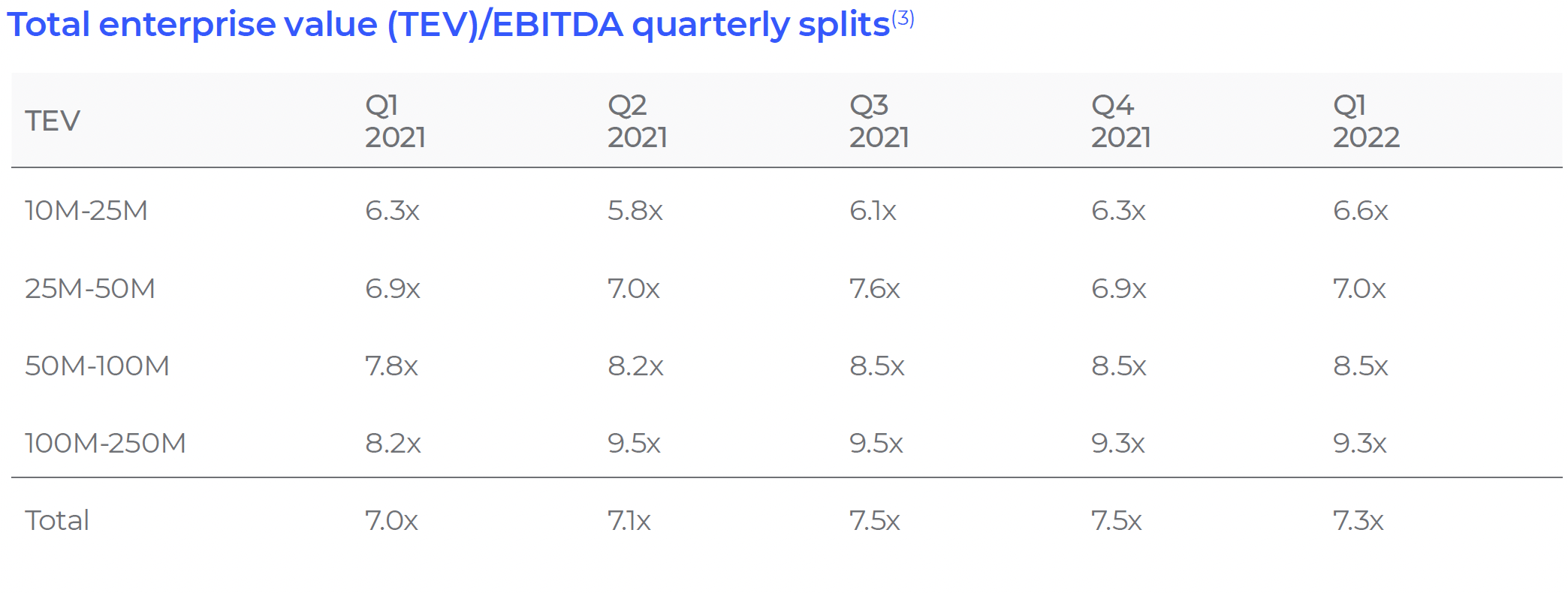

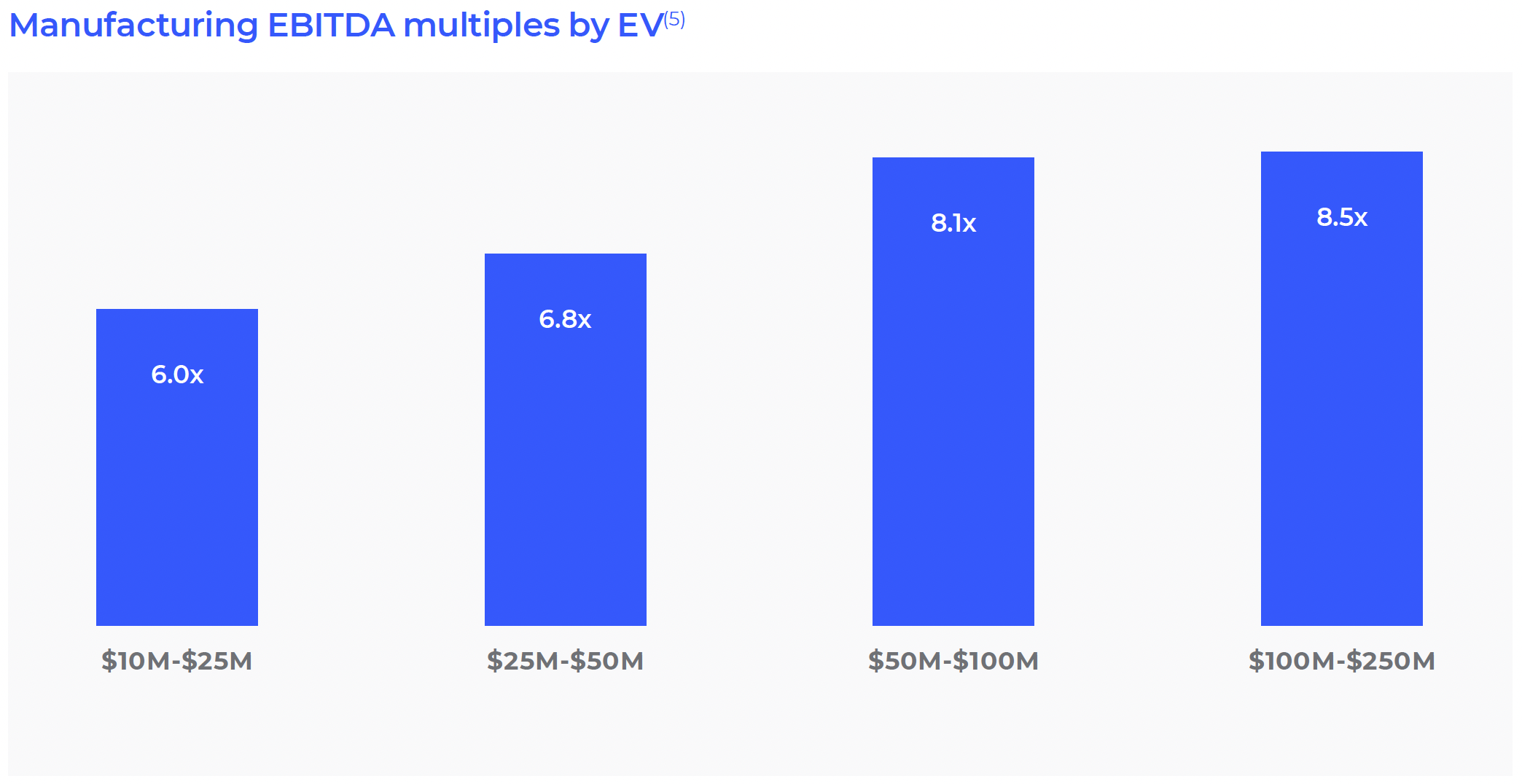

The reported transactions per GF Data show, in aggregate, middle-market valuations declined slightly from 7.5x EBITDA in Q4 2021 to 7.3x EBITDA in Q1 2022. The number and size of the transactions were significant drivers in the declining multiple.

Average debt utilization declined in Q1 2022 for the first time since Q2 2021, largely influenced by the rising interest rates. This trend follows the decline in transactional volume that was seen in Q1 2022 and may continue into future quarters.

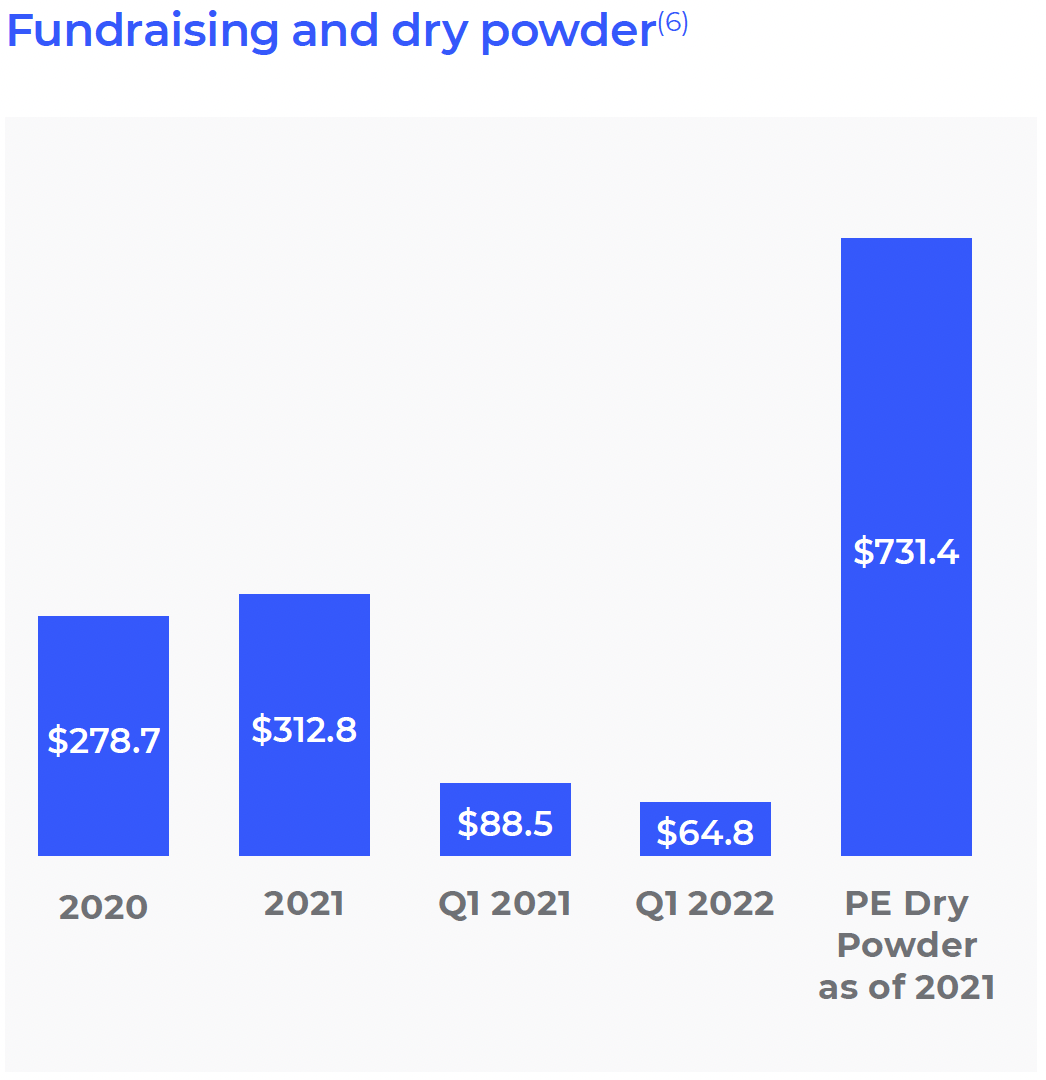

- Fundraising is slightly down compared to Q1 2021, but uncommitted dry powder amounts continue to grow.

- Middle-market fundraising remains strong as well, accounting for $38.9 billion of the Q1 2022 capital raised.

- Analysts believe that dealmaking will continue in 2022 due to the high levels of dry powder in private equity.

- The pressure for capital deployment is rising, with the expected timelines of limited partner investors and excess capital on the sidelines.(7)

About Wipfli Corporate Finance Advisors

Wipfli Corporate Finance Advisors, LLC is the investment banking and corporate finance arm of Wipfli LLP, a top 20 national accounting and consulting firm. Wipfli Corporate Finance offers tailored investment banking services for middle-market companies ($10-$250 million of revenue) and capital providers. We pride ourselves on earning our clients’ confidence through dedication to their strategic and transaction needs. Additionally, our clients benefit from the full suite of Wipfli’s services, including tax and accounting, which are critical components of the transaction process.

Looking to be more acquisitive?

Having an acquisition plan is critical. Start yours now.

Get the checklist now

Categories

Read all Market Updates and Insights

A quarterly, insightful look at middle-market merger and acquisition activity.

Thought-provoking articles on value, growth, and strategy, merger and acquisition news, research and analysis from WCF consultants.