Peak Credit Conditions and Imbalanced Valuations Point Toward Normalization of M&A Markets

Please be aware: More recent data has been published since the time of this post. To see current market trends, check out the most recent issues of Market Updates.

Middle-market deal flow remained strong in Q1 2015, supported by healthy credit markets and significant capitol that needs to be put to work. Corporate balance sheets remain flush with cosh, registering approximately $1.4 trillion, according to Federal Reserve data. Combined with private equity dry powder of $535 billion, per Pitchbook, this represents a significant driver of rising valuations. GF Data's latest report indicates private equity transaction valuations for deals between $10 million and $250 million rose across the board, despite an uptick in deal volume. But signs ore pointing toward market stabilization after several years of imbalance.

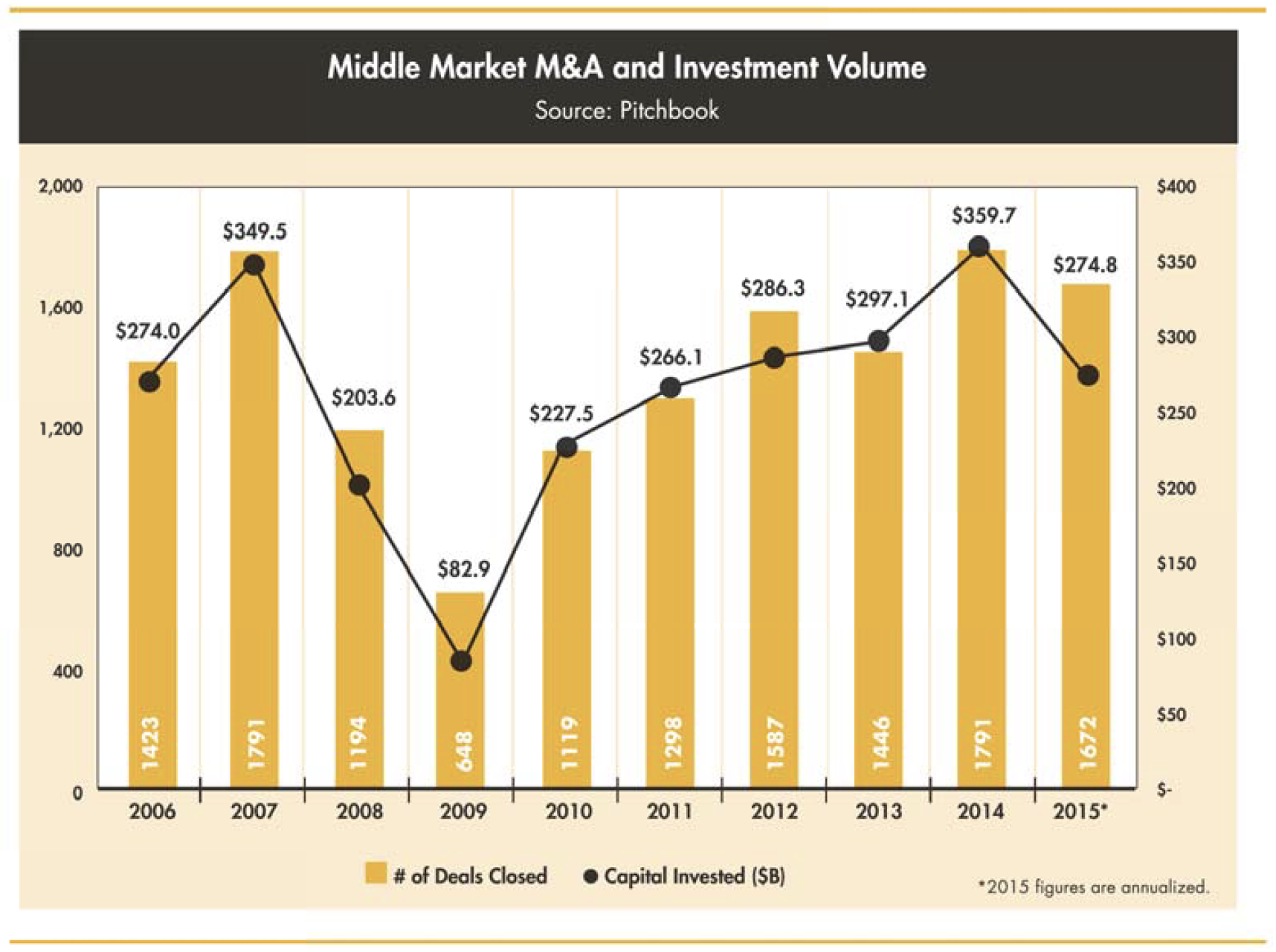

Considered the peak of previous M&A cycles and the best historical financial conditions, 2007 deal volume was equaled and capitol invested was surpassed in 2014, according to Pitchbook's analysis of middle-market deal flow. Annualizing 2015 based on first quarter data, it appears there may be a slight decline in volume and a larger decline in capitol invested compared to 2014 (using historical overage Q1 contributions, excluding the tax change at the end of 2012, deal volume would be 1,621, with capitol invested of $238.4 billion).

Imbalanced Valuations

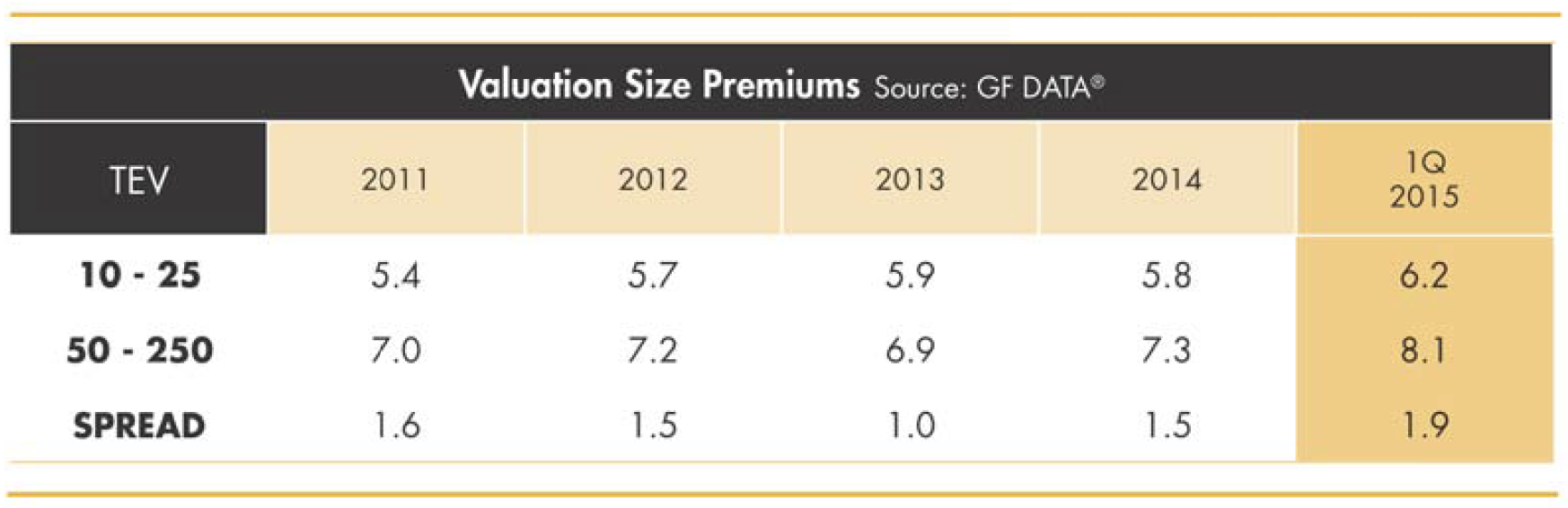

A noteworthy dichotomy developed over the past few years as higher valuations were being paid for odd-on or roll-up investments compared to platform investments among private equity buyers. According to GF Data's analysis of 2014 and first quarter 2015, transactions of $10 million to $25 million and of $100 million to $250 million registered one-half turn higher valuations for odd-ons and roll-ups. The ability to finance add-ons and roll-ups with debt and existing platform cosh flow allows private equity Firms to pay higher multiples for these businesses. When combined with the platform investment, add-ons or roll-ups provide revenue diversification, synergistic value, and multiple arbitrages for private equity owners.

In addition, the valuation spread between larger ($50 million to $250 million) and smaller transactions ($10 million to $50 million) continued to grow, rising to 1.9x trailing EBITDA. With fewer large businesses available, this spread width is not surprising and may continue to widen.

Peak Credit Conditions

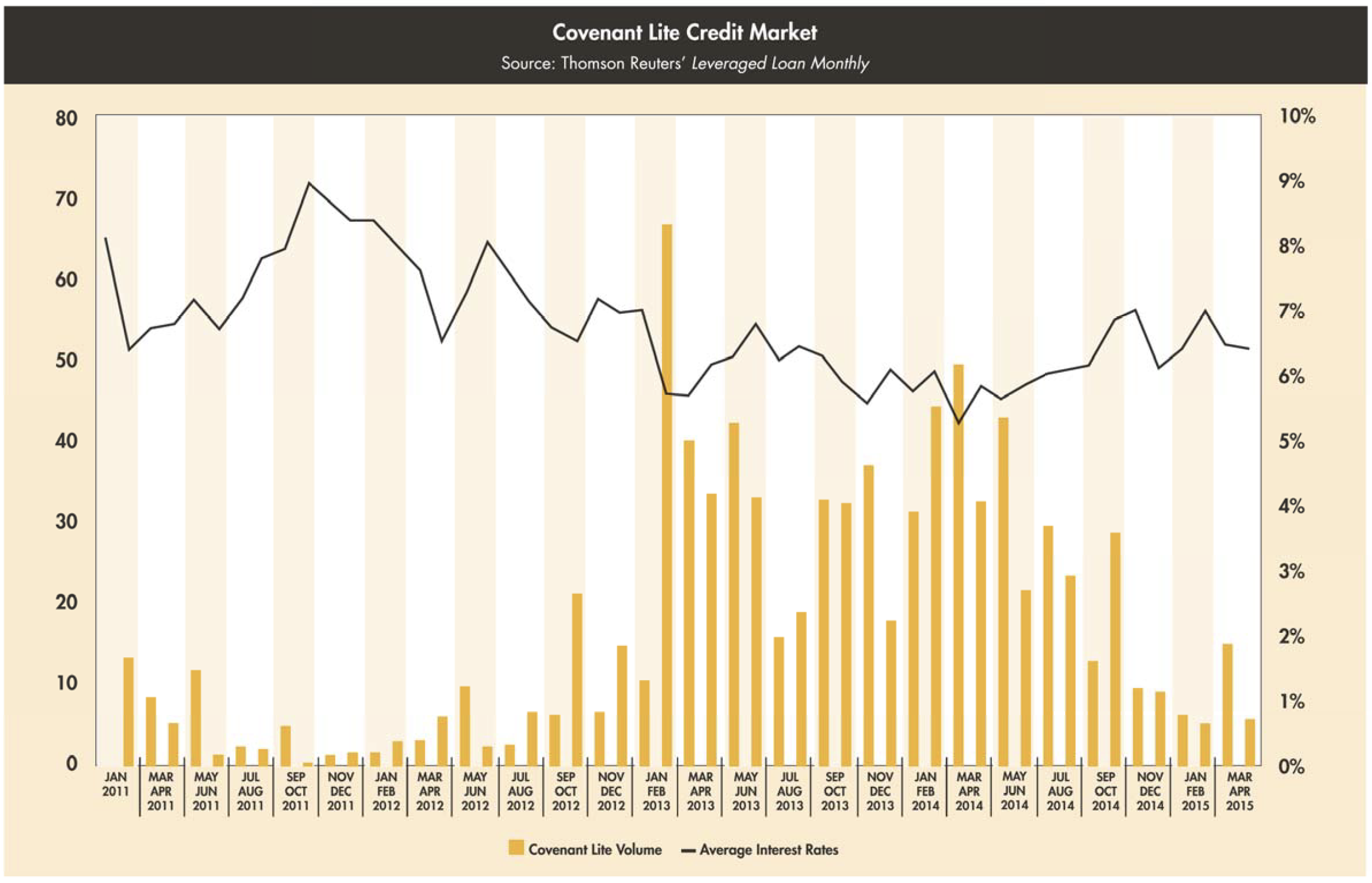

Record valuations have been partially driven by loose credit conditions. A critical component in valuation trends, leverage has likely topped out according to most lenders in the middle market. With on interest rate hike expected in the second half of 2015 or first half of 2016, credit terms are already ideal and not likely to improve from the current state as credit markets begin to tighten. According to Thomson Reuters' Leveraged Loan Monthly, new origination of middle-market leverage loans dropped to 55.2 million in the first quarter of 2015, the lowest level since Q3 2013.

Covenant-lite origination was drastically lower for the quarter compared to 2014, signaling increasing credit policy strictness.

A reduction in these more flexible loans could place downward pressure on multiples. Another indicator of changing credit markets, average middle-market leveraged loan interest rates touched 7.0% again in February before dropping back to 6.4% in April. Still, average leveraged loan rates haven1t breached 6.0% since mid-2014. Leveraged loons ore defined by Thomson Reuters as loons with a spread greater than or equal to Libor plus 175 basis points. Should a rate hike take place, acquisition funding becomes more expensive for private equity and corporate borrowers, potentially affecting valuations.

Credit Impact on Valuations

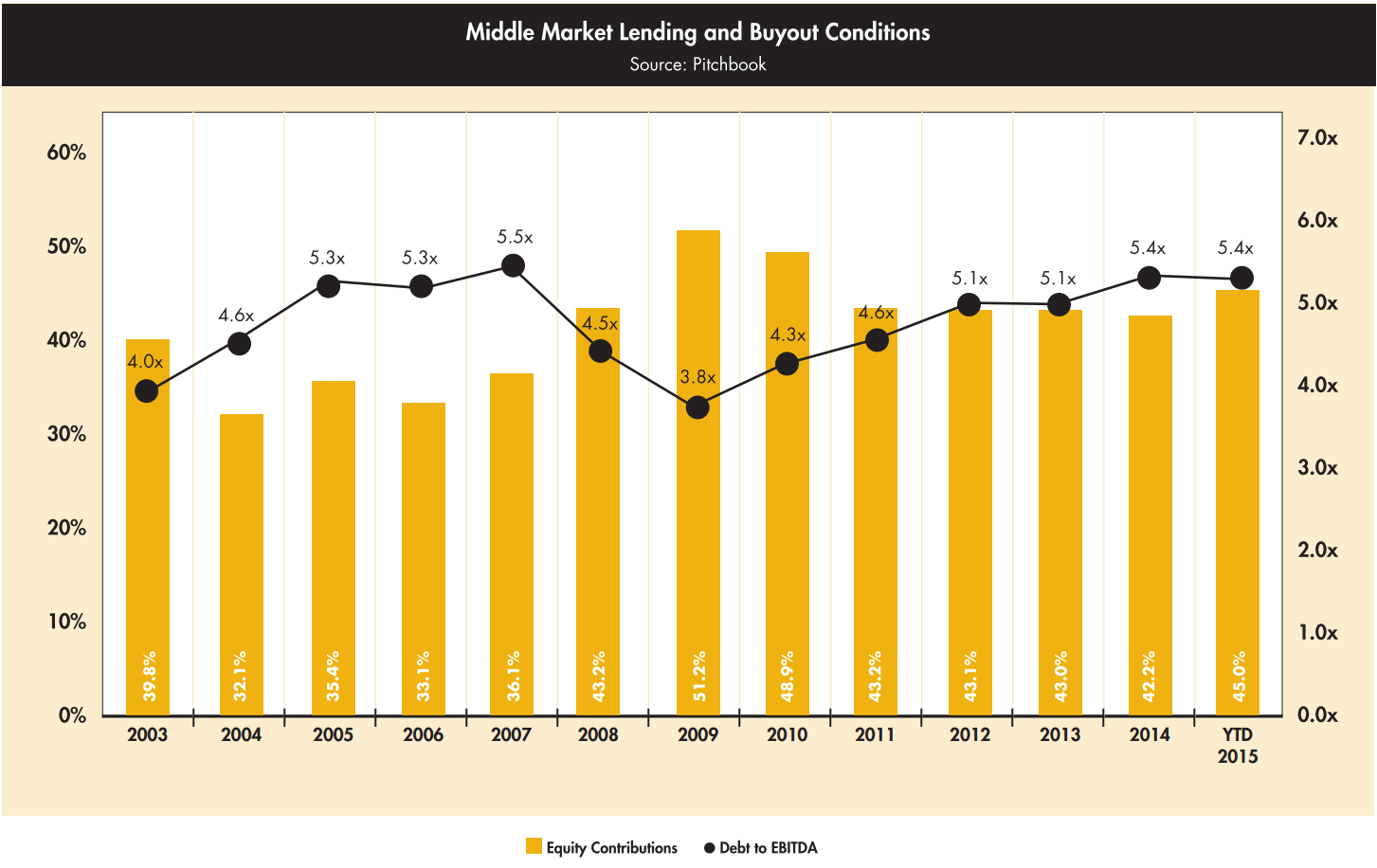

Average equity contributions for middle- market transactions rose from 42.2% to 45.0% in Q1 2015, according to Pitchbook. Increased equity requirements to complete buyouts reduce returns for private equity funds without a change in valuations. Leverage, measured by debt to EBITDA, was flat in the first quarter after rising 0.3x from 2013 to 2014.

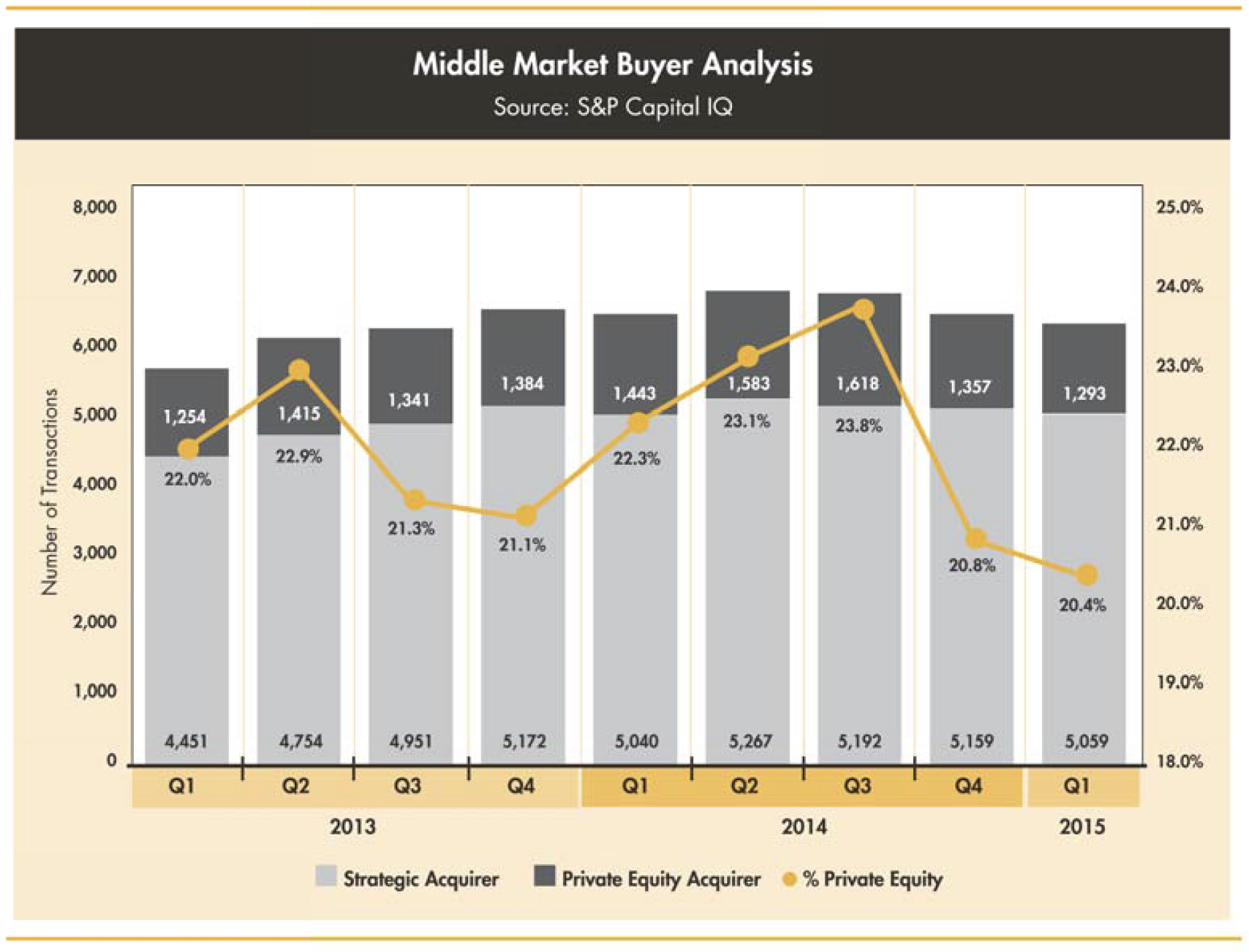

Tightening credit for private equity buyers is also evident in the decline of private equity-backed transactions as a percentage of total M&A activity. S&P Capital IQ indicates private equity accounted for only 20.4% of the buyers in Q1 2015, the lowest level in nine quarters. Without ample leverage, private equity firms ore having difficulty matching current valuation levels, a signal that valuations may normalize.

Here at Wipfli Corporate Finance, we continue to witness on insatiable appetite for companies with strong management teams, healthy margins, and niche business models. Many private equity firms we speak with are seeing an increase in the number of opportunities coming to market. Therefore, proactive preparation with on experienced M&A advisor prior to launching a sales process is in the best interest of owners contemplating a sale.

A competitive sales process yields tremendous benefits including higher transaction values, more appealing transaction terms, and an increased certainty of close. An experienced M&A advisor mitigates potential buyer concerns, validates financial statements and nonrecurring expenses, and provides strategic advice to enhance the probability of a successful transaction.

Footnote:

Middle-Market Definitions: GF Data ($10 million-$250 million), Pitchbook ($10 million-$1 billion), S&P Capital IQ ($10 million-$250 million) Thomas Reuters LPC ($10 million-$500 million)

The content of this material should not be construed as a recommendation, offer to sell or solicitation of an offer to buy a particular security or investment strategy. The content of this material was obtained from sources believed to be reliable, but neither Wipfli Corporate Finance Advisors, LLC nor RKCA, Inc., warrants the accuracy or completeness of any information contained herein and provides no assurance that this information is, in fact, accurate. The information and data contained herein is for informational purposes only and is subject to change without notice. This material should not be considered, construed or followed as investment, tax, accounting or legal ad vice. Any opinions expressed in this material are those of the authors and do not necessarily reflect those of other employees of Wipfli Corporate Finance Advisors, LLC or RKCA, Inc. Investing in the financial markets involves the risk of loss. Past performance is not indicative of future results.

Looking to be more acquisitive?

Having an acquisition plan is critical. Start yours now.

Get the checklist now

Categories

Read all Market Updates and Insights

A quarterly, insightful look at middle-market merger and acquisition activity.

Thought-provoking articles on value, growth, and strategy, merger and acquisition news, research and analysis from WCF consultants.