WCF Advisors Blog

Category:

Market Updates

A quarterly, insightful look at middle-market merger and acquisition activity.

Private Equity Deal Volume Rises on Debt Availability and Capital Overhang

Sep 01, 2014

|

Market Updates

Private equity-backed, lower middle market deal volume rose in contrast to a small decline in total transaction volume for companies of the same size during the second quarter of 2014. According to GF Data's analysis of transactions between $10 and $250 million of enterprise value, private equity transaction volume increased by 20% and the average multiple paid by financial sponsors was 6.4x EBITDA in the second quarter, up slightly from 6.3x the prior period. However, transaction multiples were...

Bullish on 2014 Deal Volume and Purchase Price Multiples

Jun 01, 2014

|

Market Updates

Per PitchBook, U.S.-bosed private equity deal making in 1Q 2014 dropped slightly from 4Q 2013 but remained in line with quarterly deal flow totals from the previous three years, in one of many indicators that PE investment in 2014 should continue to remain relatively strong.

The $108 billion invested and 589 transactions closed in the first quarter were both less than the $151 billion in capitol invested and 633 deals from 4Q 2013, but both 1Q figures put 2014 on pace for a year strikingly...

Valuations Continue to Rise in Seller's Market

Mar 01, 2014

|

Market Updates

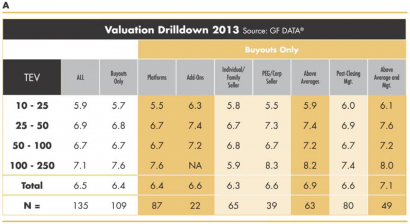

Valuation multiples are up, while transaction volume is down, showing a continuing seller's market in which deal demand exceeds supply. The number of transactions closed by Gf Data's 187 active data contributors in 2013 totaled 135, the lowest level since 2009, despite capital overhang (the amount of available funds) at near record levels. Further evaluation of the valuation multiples reveals some interesting trends.

Platform acquisitions by PE firms have traditionally been made at higher...