Strategic Buyers Pay up for Opportunities

Please be aware: More recent data has been published since the time of this post. To see current market trends, check out the most recent issues of Market Updates.

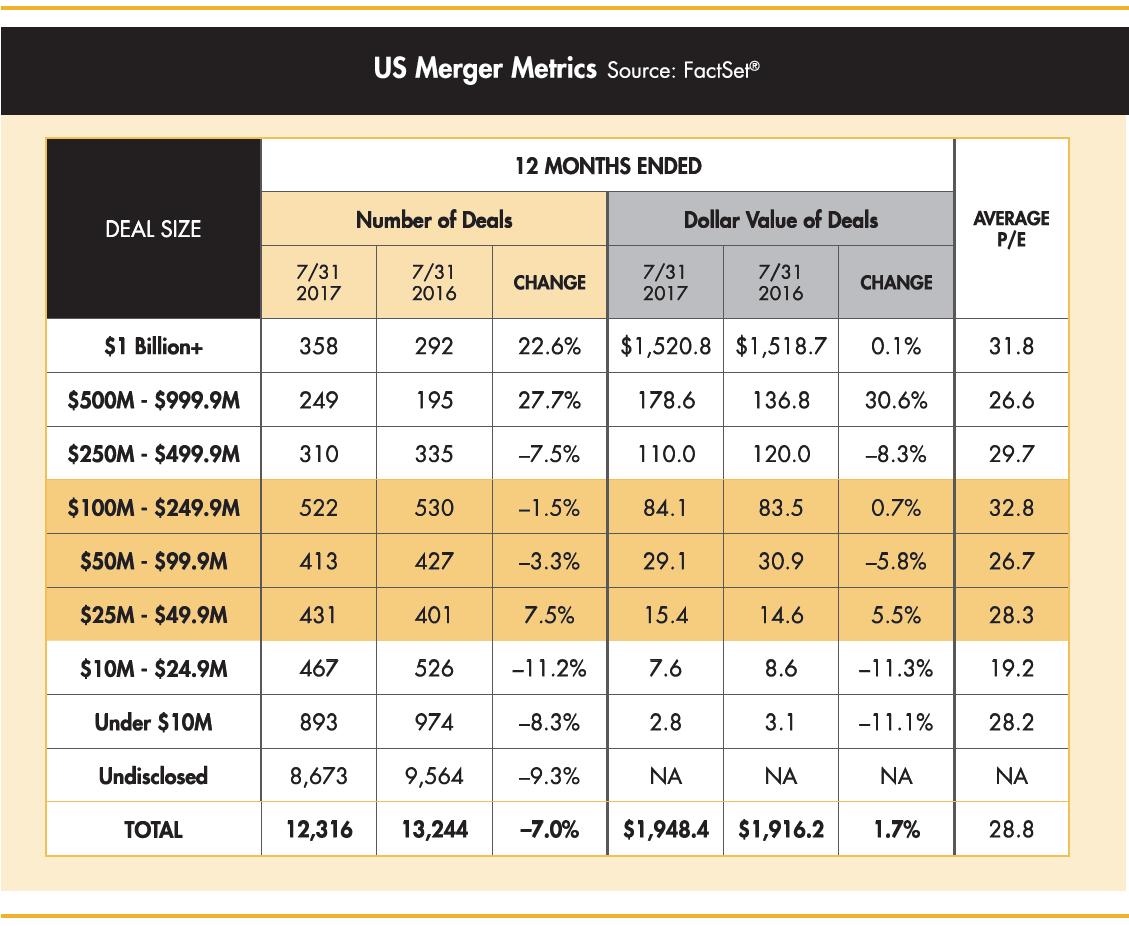

The M&A market is somewhat a tale of two markets, large and small. While the middle market ($50M to $500M in deal value) has remained relatively stable, mega deals ($500M in deal value and above) have dominated in terms of volume and value. The number and value of mega deals have increased year over year in 2017, while middle market deals have trended slightly behind and lower middle market deals have declined. Similar to what we reported last quarter, total deal volume in the United States for the 12 months ended July 2017 decreased 7%, while the total transaction value increased 1.7%. The increase in value is at the mega deal size.

Strategic buyers have dominated the market in the last 12 months for public company transactions, closing 73% of total deals reported by Factset. This is a far greater percentage than in the middle and lower middle markets, where most targets are privately held. In the lower middle market, defined by Marketpulse as deals valued at $5M to $50M, Private Equity (PE) buyers in the second quarter are reported to have acquired 40% of deals, while strategic buyers acquired 27%. PE buyers, however, report strong competition in valuations from strategic buyers, indicating that strategic transactions may be coming down in deal size and not just focusing on large deals.

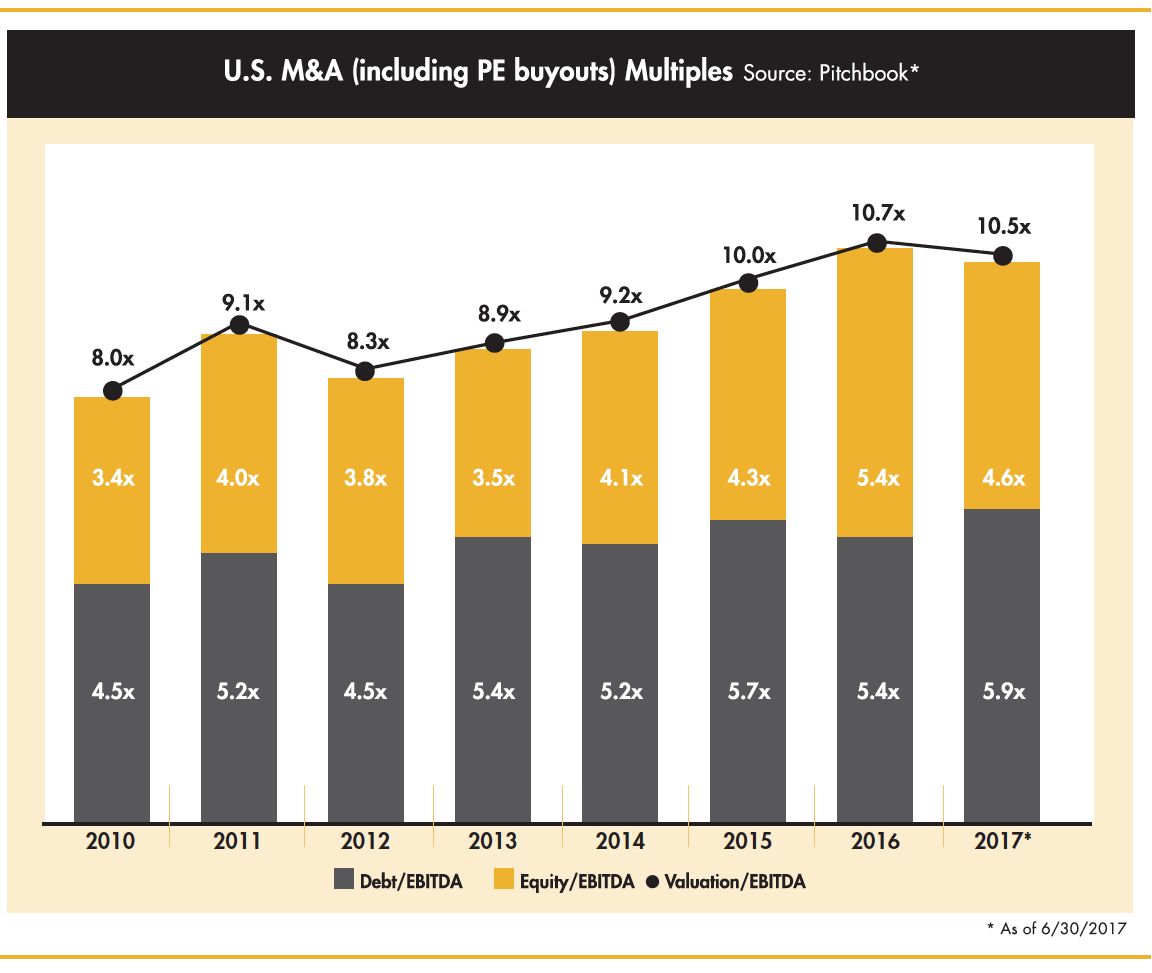

In Pitchbook’s Q2 2017 report, PE deal flow is shown to be slightly behind last year’s pace at 866 deals, totaling $151.1 billion. Multiples remain close to 2016’s seven-year high mark of 10.7x, having declined slightly to 10.5x. The median debt percentage has risen to 56.3% of enterprise value, well above the 50% reported in the prior year. This is consistent with GF Data’s Q2 report, which also reflects an increase in leverage in 2017 over 2016, countering the sentiment that leverage multiples were retrenching.

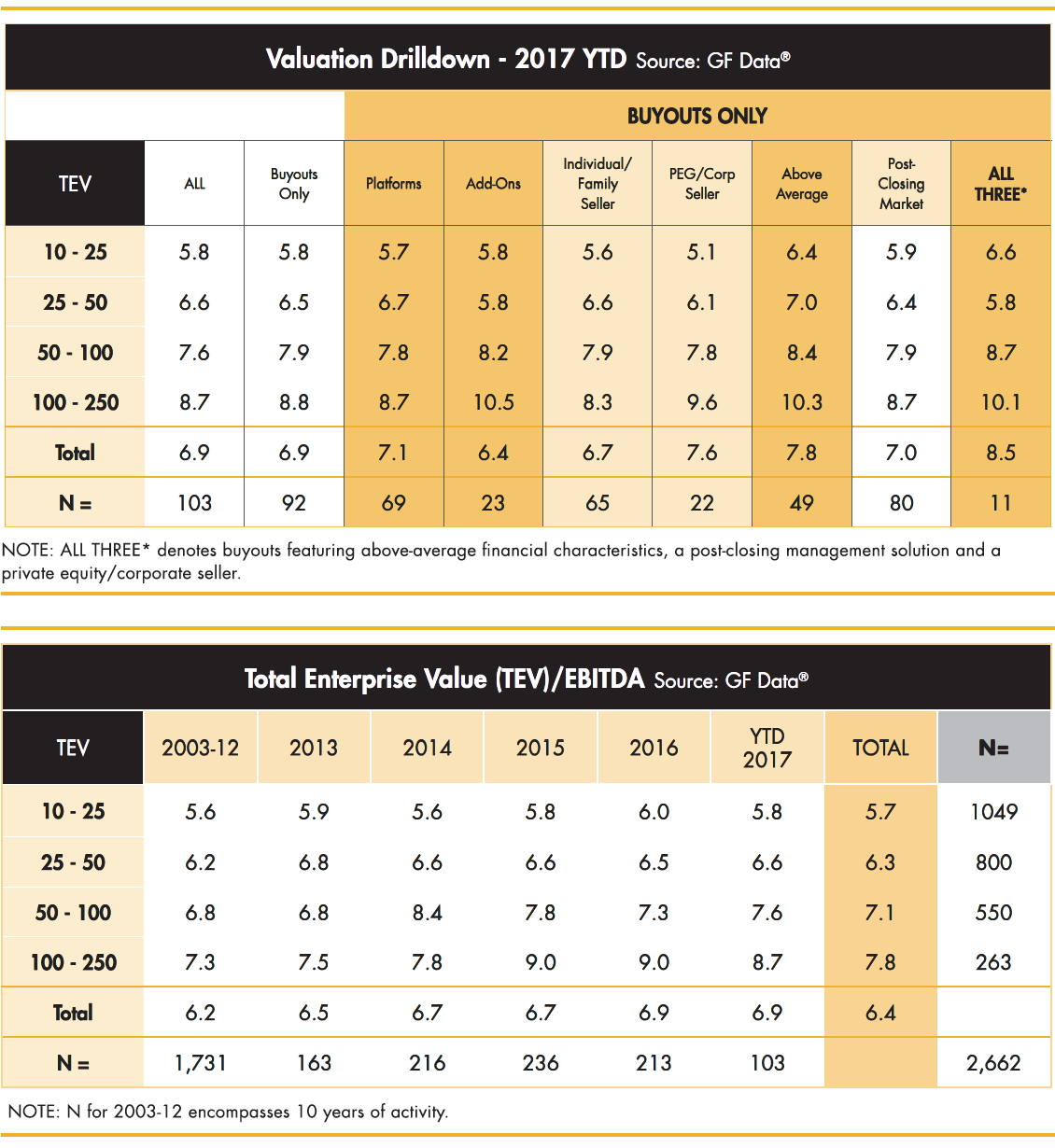

GF Data provides a further breakdown of valuations for 2017 by total enterprise value and type of transaction. This data shows PE buyers continuing to place a premium on size, above-average financial performance, and institutional ownership prior to purchase. Valuations in the lower middle market have trended flat over the past five years, while valuations for transactions $100M and above in value have shown a general upward trend.

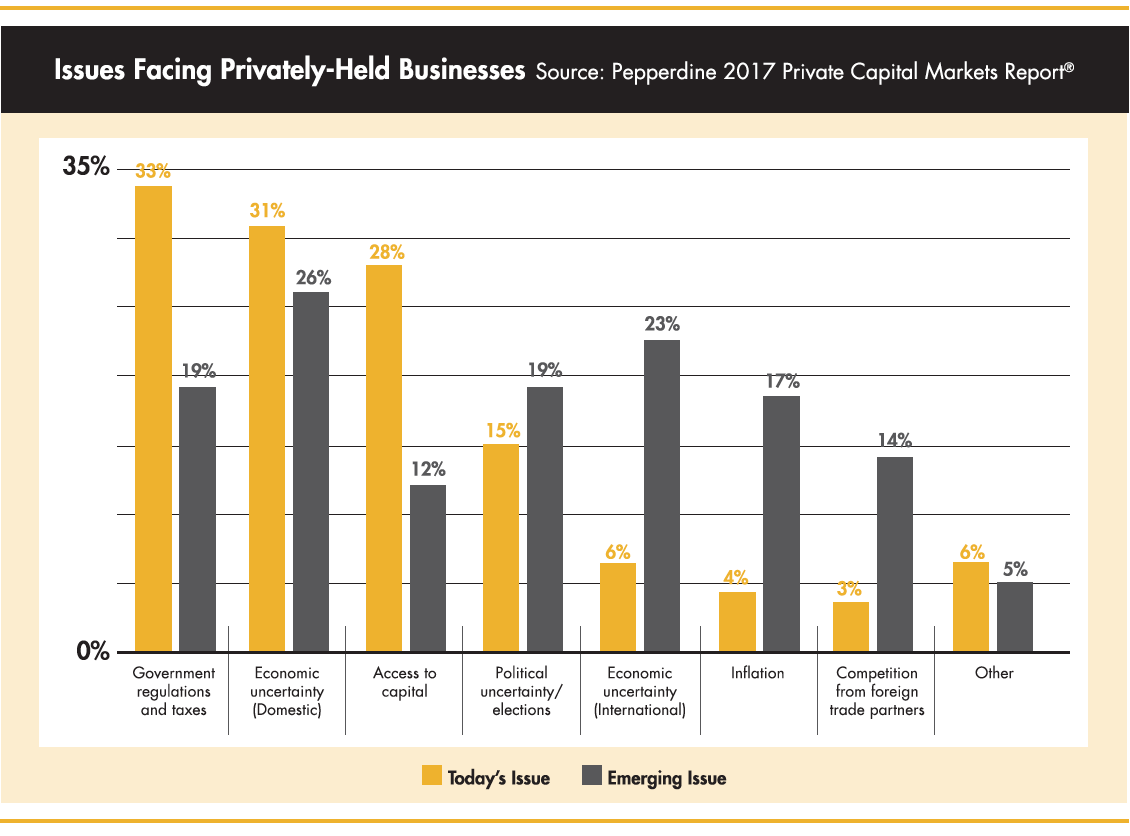

The caution buyers are displaying in the middle market appears to be tied to a large degree to the present political and economic climates. Pepperdine’s 2017 Private Capital Markets Report respondents believe government regulation and taxes and economic uncertainty are the most important risks facing privately held businesses in 2017.

It appears the political and economic climates are contributing to caution by buyers as well as lenders. Leverage remains available, and middle market buyers are showing continued interest in activity but are displaying caution in overpaying for deals. Multiples are increasing only on larger and above-average-performing companies where there is significant buyer interest and where one party ultimately is willing to pay up for the deal.

Accordingly, the M&A market is somewhat a tale of two markets, one driven by significant activity by strategic buyers where valuations and leverage remain on an upward trend and the other driven by significant dry powder waiting to be deployed but also by caution of risk factors in the target and its environment. In the middle market, we see strong activity with a healthy pool of financial and strategic buyers. Valuation multiples remain healthy and stable. Debt financing remains available. The record premiums being paid in this market for companies that have above-average financial performance and growth opportunities tell us that sellers should remain diligent in focusing on their business fundamentals. If there are business fundamentals that are perceived as risky to the business’s future, value will be lower and buyer interest will be significantly impacted. Our WCF and/or Wipfli teams need to be talking with you about how to right the ship. If the business fundamentals are strong, the market prospects are very good, and now is a great time to discuss and evaluate your options.

Our skilled WCF team brings a strong understanding of how to maximize value and position your company to various buyer groups. Preparation and process are the keys to achieving the best results.

The content of this material should not be construed as a recommendation, offer to sell or solicitation of an offer to buy a particular security or investment strategy. The content of this material was obtained from sources believed to be reliable, but neither Wipfli Corporate Finance Advisors, LLC nor RKCA, Inc., warrants the accuracy or completeness of any information contained herein and provides no assurance that this information is, in fact, accurate. The information and data contained herein is for informational purposes only and is subject to change without notice. This material should not be considered, construed or followed as investment, tax, accounting or legal ad vice. Any opinions expressed in this material are those of the authors and do not necessarily reflect those of other employees of Wipfli Corporate Finance Advisors, LLC or RKCA, Inc. Investing in the financial markets involves the risk of loss. Past performance is not indicative of future results.

Looking to be more acquisitive?

Having an acquisition plan is critical. Start yours now.

Get the checklist now

Categories

Read all Market Updates and Insights

A quarterly, insightful look at middle-market merger and acquisition activity.

Thought-provoking articles on value, growth, and strategy, merger and acquisition news, research and analysis from WCF consultants.