Peak or No Peak

Please be aware: More recent data has been published since the time of this post. To see current market trends, check out the most recent issues of Market Updates.

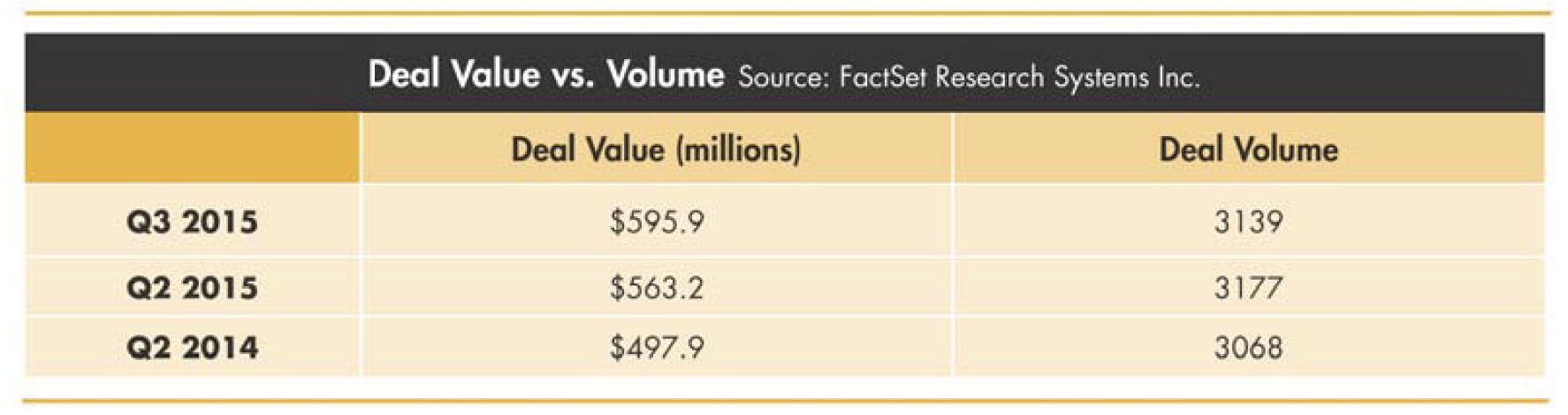

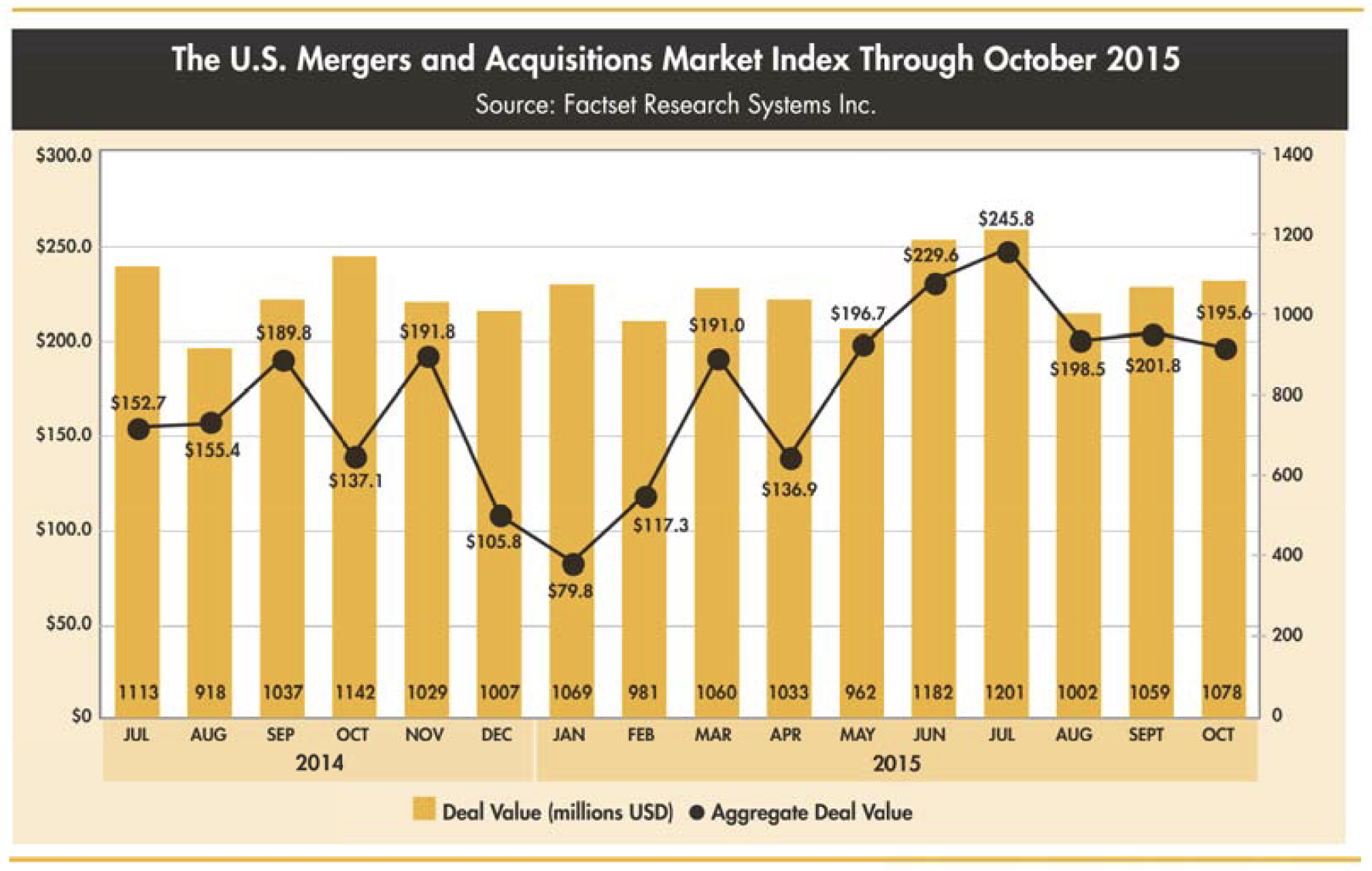

Consistent with last quarter, M&A deal volume in the United States decreased in the third quarter of 2015 compared to the second quarter of 2015 while deal value increased. According to FactSet Mergerstat, year over year, deal volume also decreased while total deal value increased , a clear result of higher purchase price multiples on larger deals.

The sectors seeing the largest increase in value in the past three months over the same three months in the prior year include Consumer Non-Durables and Electronic Technology. Of the 21 sectors reported by FactSet Mergerstat, 11 saw increases in value, while 10 saw decreases.

The sectors that have seen the biggest increases in activity in the past three months relative to the prior year include Commercial Services, Technology Services, Health Services, and Retail Trade. The sectors seeing the largest declines in volume include Industrial Services, Finance, Producer Manufacturing, Consumer Services, and Energy Minerals.

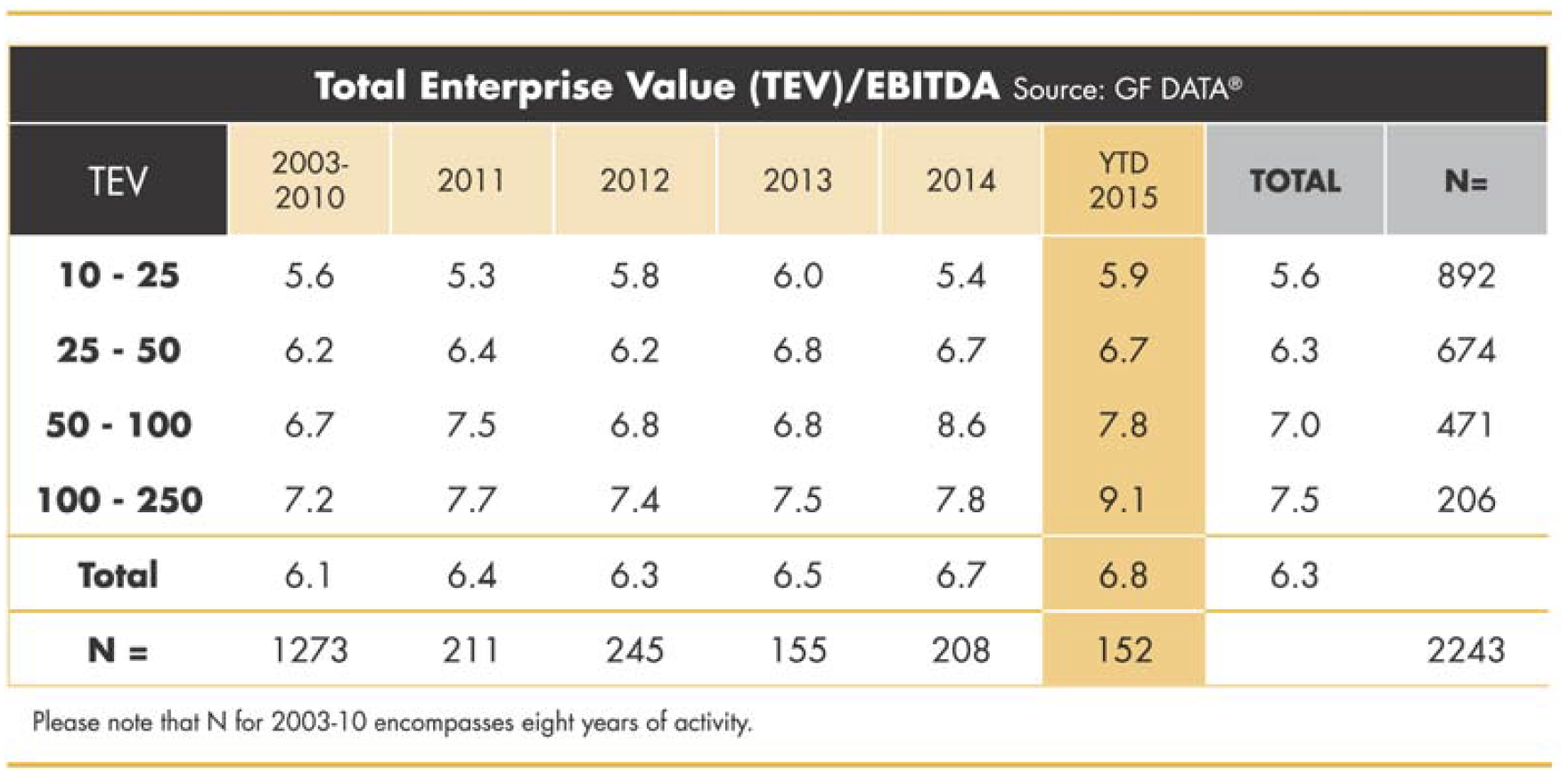

GF Data®, whose database consists solely of private equity buyers, also reported an increase in deal value (7.1x versus 6.7x EBITDA) and a decrease in deal volume (37 versus 50 transactions completed) in the third quarter. In an October 30, 2015, article, "Calling The Crest," Andrew Greenberg, CEO of GF Data, analyzed how the impending tightening of credit markets will affect deal values of different sizes in the middle market, given that leveraged finance is more available to and utilized more heavily by the buyers of larger companies.

Mr. Greenberg concluded that for deals in the $100 million to $250 million enterprise value range compared to deals in the $1 0 million to $25 million bracket, the leverage premium accounted for about half, or 1 .2x EBITDA, of the differential in valuation multiple from 8.3x TIM EBITDA to 6.0x in the two size categories.

As of Q3 2015, GF Data reports on increase in total enterprise value as a multiple of EBITDA in three of four size categories over 2014 as shown in the following table:

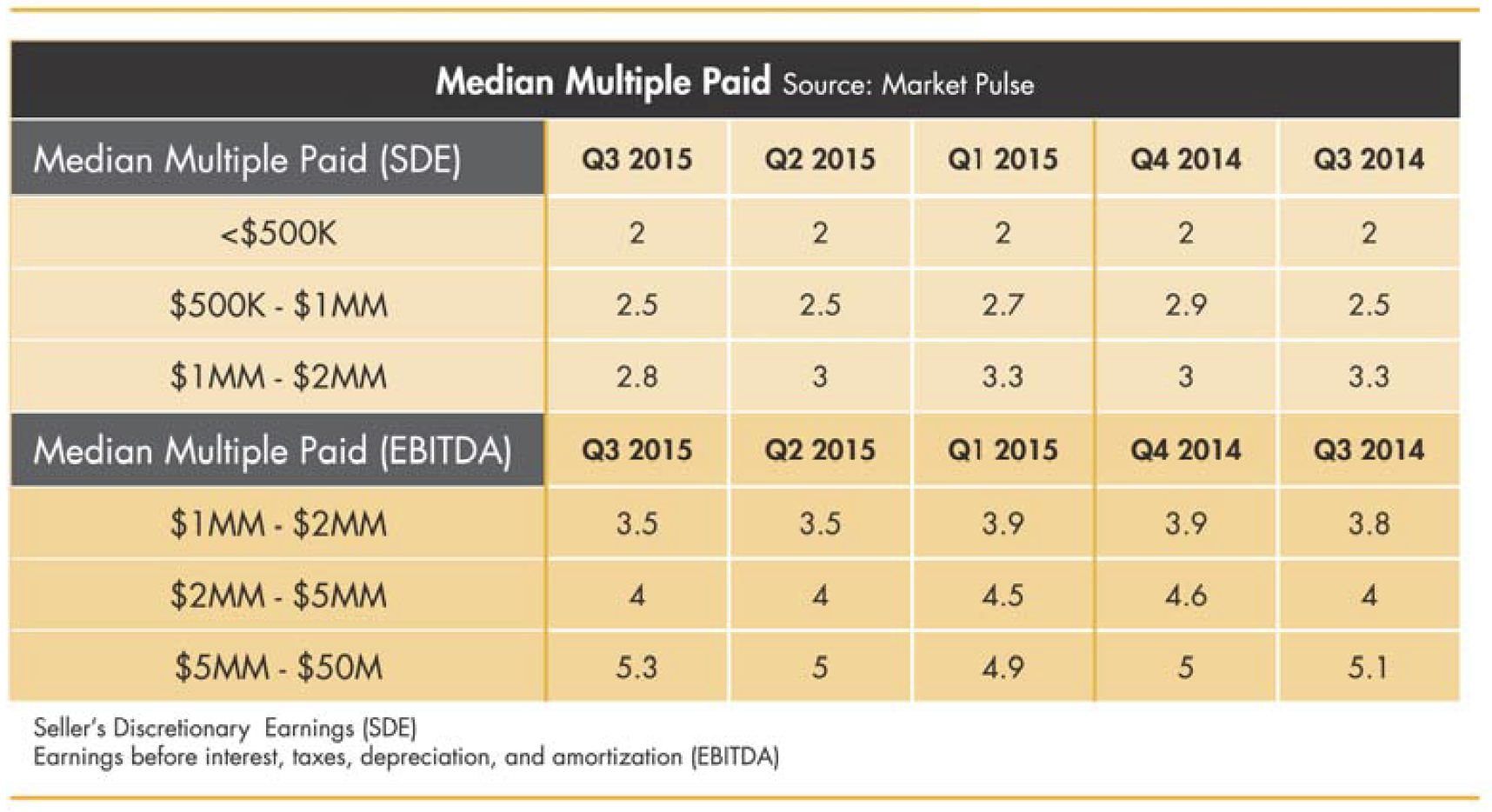

This is fairly consistent with the Market Pulse Third Quarter 2015 report, which tracks deal activity for Main Street or smaller companies up to $50 million in purchase price. As shown in the table below, for smaller companies, for which leverage ratios hove not risen as much as for larger companies, deal multiples have remained fairly steady over the past five quarters. The only category showing on increase in valuation multiples over this time is the $5 million to $50 million enterprise value range, where increased leverage has been utilized to support higher purchase price multiples.

Thus, the debate of late has largely been about what effect increasing interest rates and possible tightening of the credit markets will have on M&A activity. It is widely believed that it will have some impact on the lower middle market. However, where there is less institutional capitol on Main Street deals of $5 million or below in value, it will likely have minimal impact.

At Wipfli Corporate Finance Advisors, we have seen continued strong demand by private equity and strategic buyers, particularly for platform and odd-on acquisitions with strong growth prospects; EBITDA margin reflecting a niche or value-added product or service; and quality management. Capital remains readily available in the near term, outpacing the supply of qualified sellers. In an environment reported to be a seller's market for deals valued at $5 million or above and a buyer's market for deals valued at less than $5 million, it makes one wonder if we will see more roll-up strategies or a continued shift by private equity buyers to do smaller deals. Tremendous value growth is available in size and scale.

The right time to sell is based on many factors, certainly including the company's financial performance and owners' goals and objectives. For companies with marginal performance, we strongly recommend working with Wipfli and Wipfli Corporate Finance Advisors to examine transition options at least two years prior to a planned exit and preferably three to five years prior. For companies with EBITDA margins that are consistently l0% or greater, growth prospects, and a quality customer base, exit options remain plentiful. Advisors participating in the MorketPulse survey report that the length of time to complete o deal has increased in 2015 over 2014, illustrating the importance of a skilled M&A advisor in an increasingly complex and uncertain environment. Our skilled WCF team brings not only buyer relationships, but on understanding of what various buyer groups value and evaluate and how to negotiate through obstacles that arise. Opportunities to skillfully negotiate favorable valuation for our client sellers abound.

The content of this material should not be construed as a recommendation, offer to sell or solicitation of an offer to buy a particular security or investment strategy. The content of this material was obtained from sources believed to be reliable, but neither Wipfli Corporate Finance Advisors, LLC nor RKCA, Inc., warrants the accuracy or completeness of any information contained herein and provides no assurance that this information is, in fact, accurate. The information and data contained herein is for informational purposes only and is subject to change without notice. This material should not be considered, construed or followed as investment, tax, accounting or legal ad vice. Any opinions expressed in this material are those of the authors and do not necessarily reflect those of other employees of Wipfli Corporate Finance Advisors, LLC or RKCA, Inc. Investing in the financial markets involves the risk of loss. Past performance is not indicative of future results.

Looking to be more acquisitive?

Having an acquisition plan is critical. Start yours now.

Get the checklist now

Categories

Read all Market Updates and Insights

A quarterly, insightful look at middle-market merger and acquisition activity.

Thought-provoking articles on value, growth, and strategy, merger and acquisition news, research and analysis from WCF consultants.