Is the Balance of Power Shifting Away From Sellers?

Please be aware: More recent data has been published since the time of this post. To see current market trends, check out the most recent issues of Market Updates.

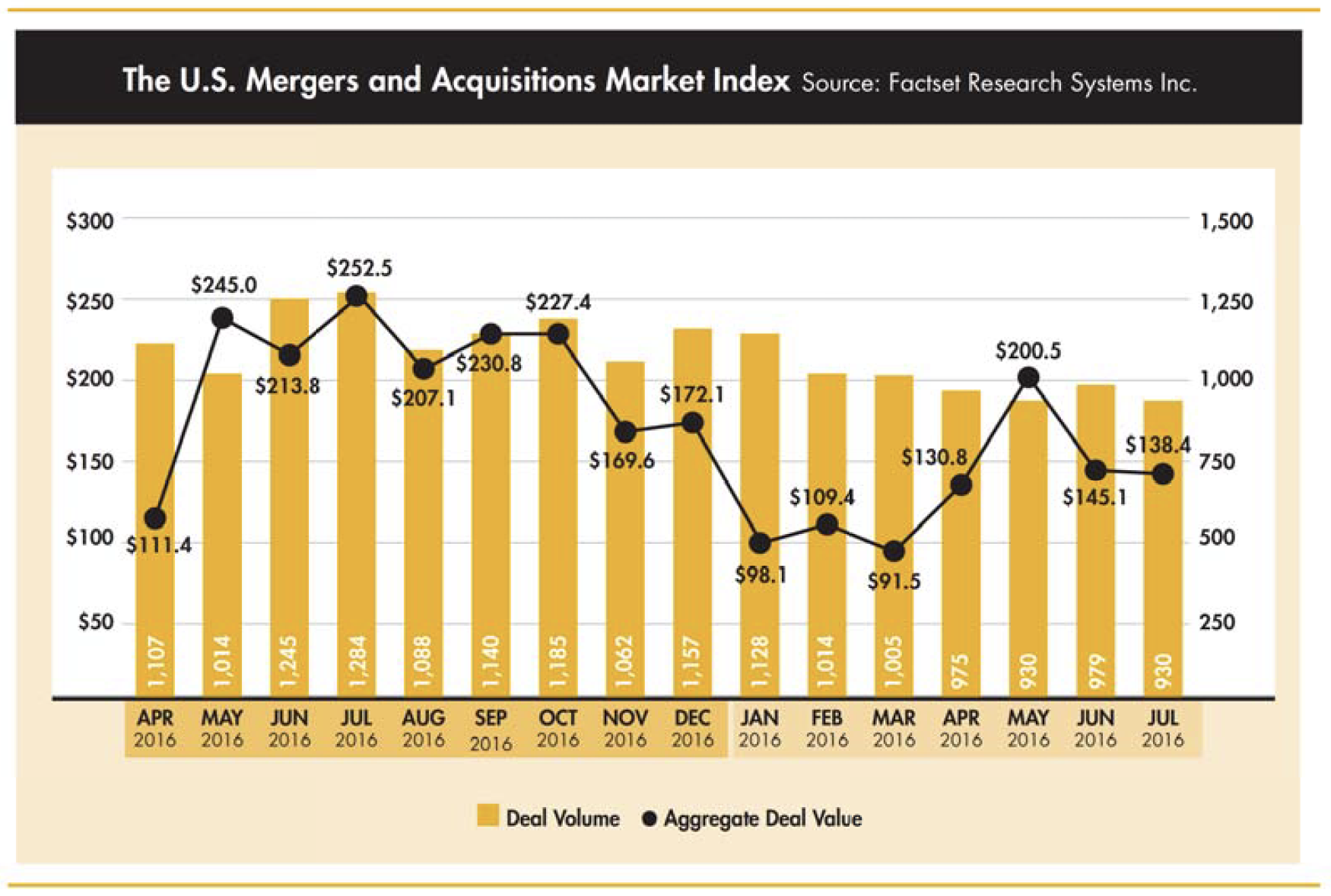

Middle-market M&A activity declined 31% year over year (YOY) in volume through August 31, according to S&P Capital IQ. In the first eight months of 2016, only 1,523 transactions were closed, compared with 2,194 over the same period in 2015. While expected, this decline represents a significant pullback from the historic M&A levels of 2015 and 2014. Although many still consider the present environment to be a sellers' market, this may signal the beginning of a change in the balance of power between sellers and buyers. Factset's US Mergers & Acquisitions Market Index confirms the decline in deal volume and value, since each month between February and July lags the 2015 monthly average.

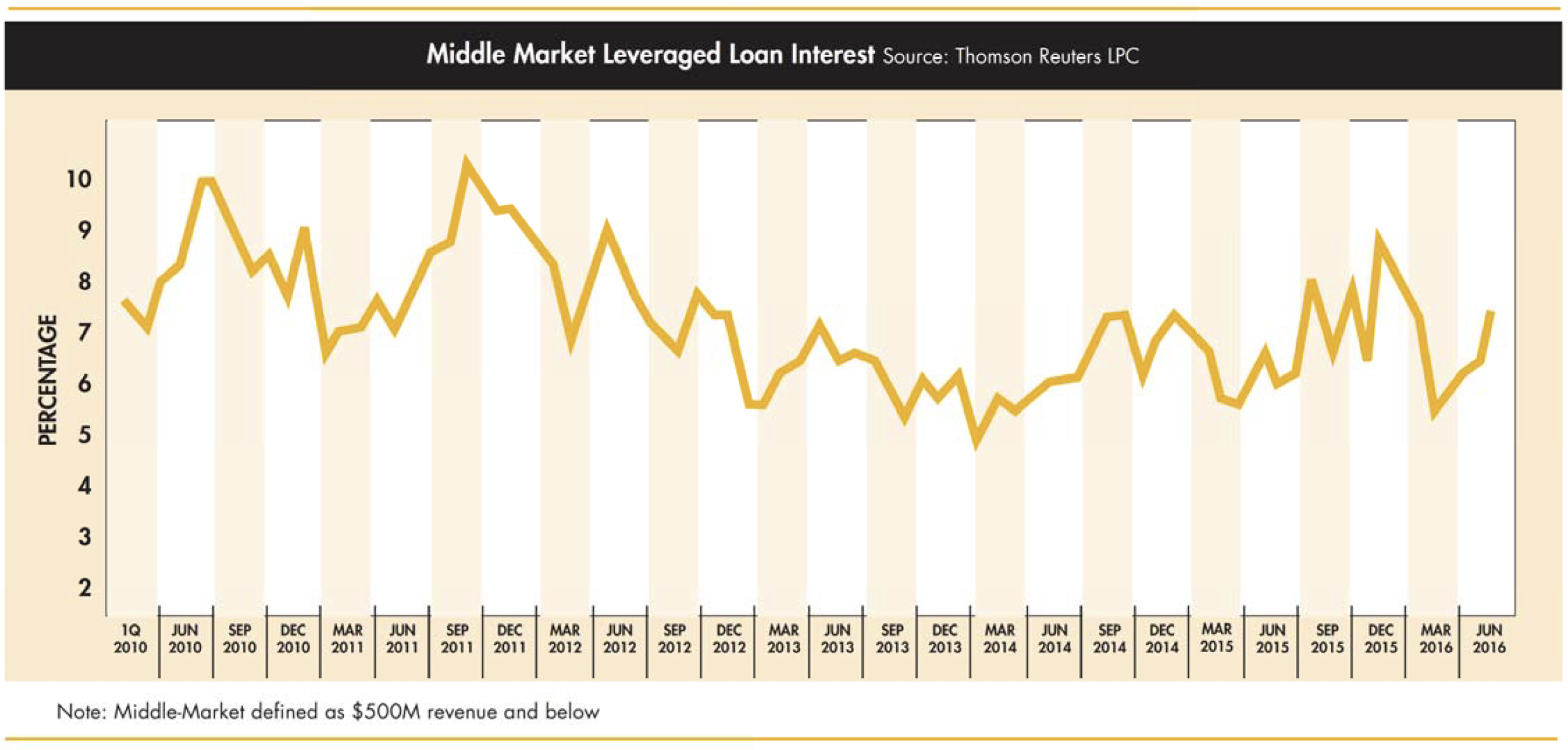

Driving the reduction in M&A volume are two primary factors: tighter credit availability and more difficulty completing transactions. Leveraged loan issuance to support middle-market M&A is down 32% YOY through August 31, totaling $63 billion, according to Thomson Reuters LPC. Tightening credit, particularly among traditional lending sources, is contributing to higher borrowing costs to finance middle-market M&A transactions.

At Wipfli Corporate Finance Advisors, continuous market discussions with our lending relationships have resulted in minor concern over certain sectors but a willingness to provide financing to worthy borrowers and scenarios. Lending opportunities supporting transactions in which management has substantial interests in the business are still appealing and command competitive pricing .

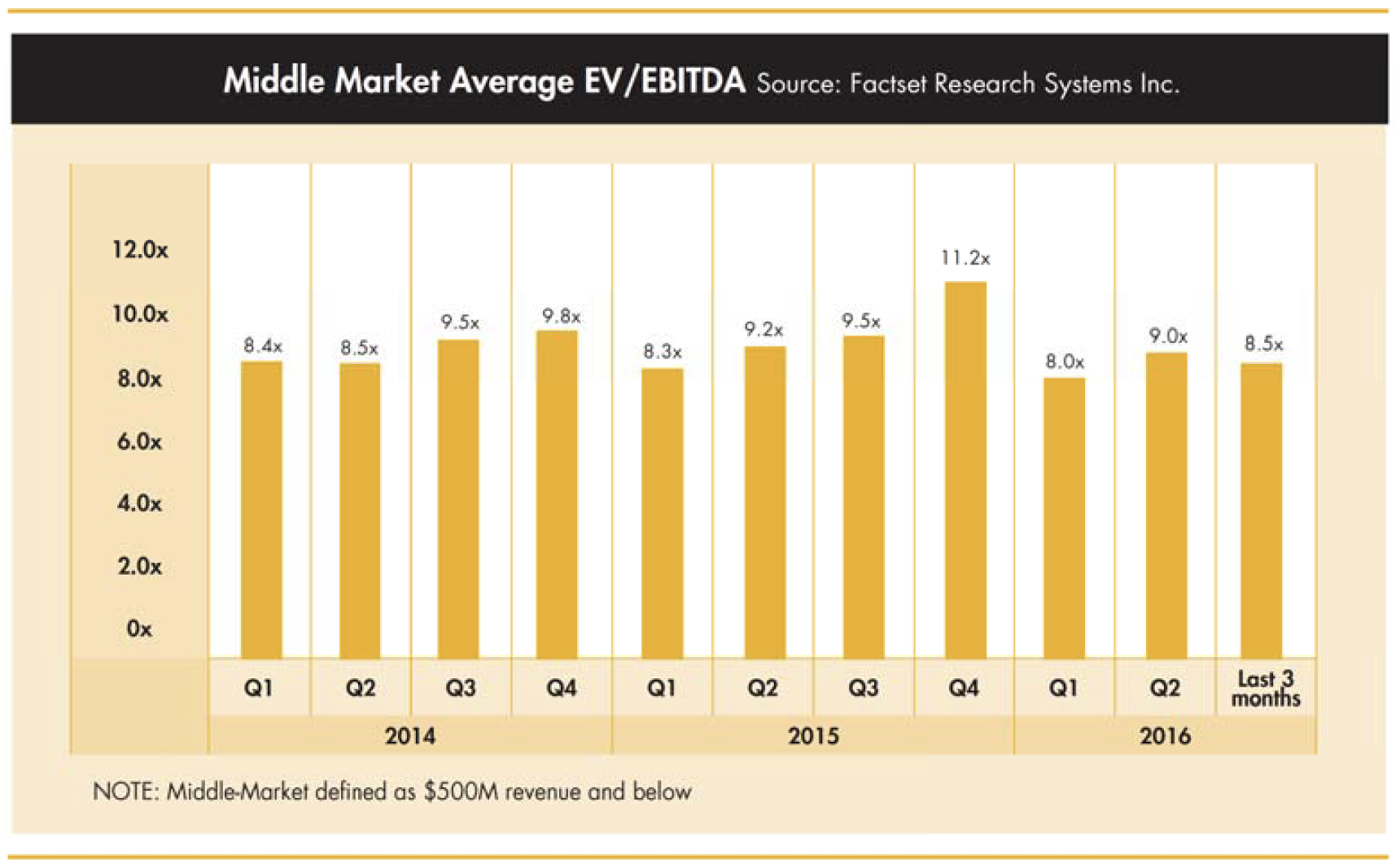

Sellers still maintain the upper hand when it comes to valuations, with middle-market multiples averaging a healthy 8.5x EBITDA over the lost three months, according to Factset, above the historical average. Higher valuations are accompanied with thorough due diligence of financials, operating processes, IT systems, and customers and suppliers. Buyers paying a steep premium have a lower margin of error to meet their return thresholds, requiring extra examination of the asset(s) being required.

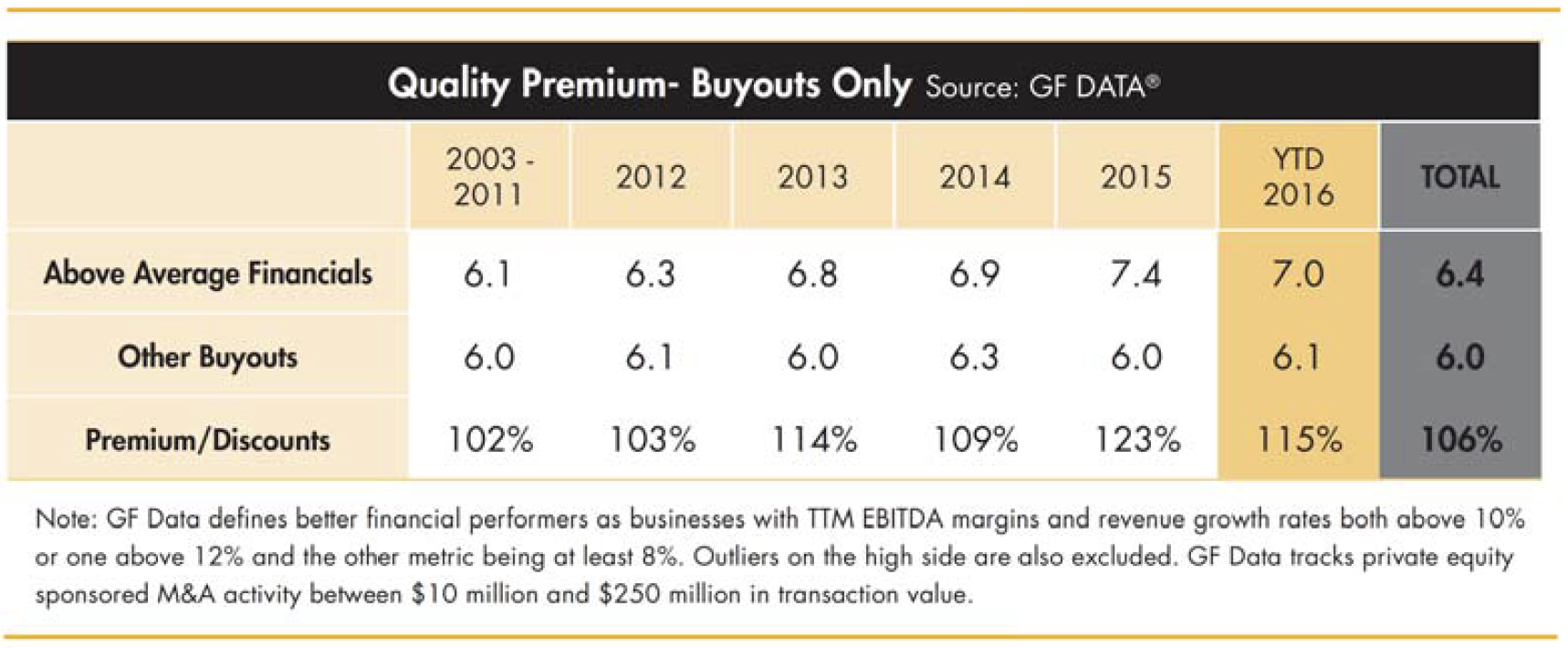

Higher margin and growth businesses are compelling to private equity buyers, as reflected in the additional 1.Ox EBITDA paid for such middle-market companies. GF Data's latest report indicates that selling businesses with above-average financials received an extra 15% premium compared to those with average or worse financial characteristics.

GF Data's latest analysis demonstrated the majority of completed middle-market transactions feature strong management teams that participate in the business post-transaction. However, a clear trend is emerging in which prior institutionally owned businesses are able to attract higher multiples than family-owned and closely held businesses. Much of the differential is simply explained by a lack of experience and preparation on the part of non- institutional sellers.

If you are contemplating a sale in the next few years, we recommend working with an investment bank, such as Wipfli Corporate Finance Advisors, to effectively plan your company's "go to market" strategy and proactively address any concerns such as filling out a quality management team. Our accomplished team of advisors is able to provide strategic advice and create a roadmap that will help you maximize the value of your business when you decide to sell. Whether or not the balance of power between buyers and sellers is shifting can be debated, but a good M&A advisor can add significant value by bringing eager buyers, running a tight deal process, and negotiating on your behalf to ensure that your personal and business needs are satisfied.

The content of this material should not be construed as a recommendation, offer to sell or solicitation of an offer to buy a particular security or investment strategy. The content of this material was obtained from sources believed to be reliable, but neither Wipfli Corporate Finance Advisors, LLC nor RKCA, Inc., warrants the accuracy or completeness of any information contained herein and provides no assurance that this information is, in fact, accurate. The information and data contained herein is for informational purposes only and is subject to change without notice. This material should not be considered, construed or followed as investment, tax, accounting or legal ad vice. Any opinions expressed in this material are those of the authors and do not necessarily reflect those of other employees of Wipfli Corporate Finance Advisors, LLC or RKCA, Inc. Investing in the financial markets involves the risk of loss. Past performance is not indicative of future results.

Looking to be more acquisitive?

Having an acquisition plan is critical. Start yours now.

Get the checklist now

Categories

Read all Market Updates and Insights

A quarterly, insightful look at middle-market merger and acquisition activity.

Thought-provoking articles on value, growth, and strategy, merger and acquisition news, research and analysis from WCF consultants.