WCF Advisors Blog

Abundant Debt and Robust Valuations Characterize First Quarter

Jun 27, 2018

|

Market Updates

With a strong 2017 in the rearview mirror, mergers and acquisitions (M&A) activity in the first quarter continued last year’s themes of high valuations and strong use of debt.

According to GF Data®, middle-market deal valuations and use of debt remain robust, with an average TEV/EBITDA multiple of 6.9x and an average Debt/EBITDA multiple of 4.2x. In addition, middle-market companies are reporting the highest rate of revenue and employment growth since one year ago, and confidence...

Looking Back, Looking Forward, Looking Up!

Mar 12, 2018

|

Market Updates

M&A activity finished strong in 2017, despite some deals choosing a January close for tax purposes, which potentially underinflates the 2017 volume and buoys January 2018 volume. Factset reports a total 2017 deal volume of 11,673 deals worth $1.7 trillion. January deal volume increased, totaling 910 deals versus 819 in December.

Valuations remain strong in the middle market, with GF Data® reporting an “eye-popping continued surge in valuations in the fourth quarter” from its...

Let the Good Times Roll

Jan 11, 2018

|

Market Updates

To say the third quarter was strong would be an understatement. With valuations and leverage levels at nearly all-time highs, it is clearly a seller’s market in the middle and lower-middle markets. In fact, according to Pitchbook, valuations reached their highest level on record during the quarter. These observations beg the question, “What’s driving the markets, and how long will it last?”As everyone knows, financial and economic markets are cyclical. So the...

How to Monetize Your Business Without a Complete Sale

Nov 08, 2017

|

Market Insights

Most business owners understand that an exit strategy should include maximizing their return on investment (ROI). Traditionally, business owners sought out two strategies to do this:

Developing a dividend stream (annual cash flow) that pays increasing amounts each year as the business grows

Selling 100% of the business and reaping the capital gains

However, more and more middle market companies are choosing a recapitalization path as a means to distribute cash to their owners without an...

What’s Your Company Worth? An Introduction to Advanced Planning for Business Owners

For many owners of closely held businesses, their business is their retirement plan — understandably, saving for retirement can often take a backseat to investing more capital in the business, and the proverbial retirement-planning can gets kicked further down the road.

Though an eventual sale of their business interest may provide a windfall large enough for long-term financial security, it’s still essential for business owners to understand the value of their company, now and in...

Strategic Buyers Pay up for Opportunities

Sep 21, 2017

|

Market Updates

The M&A market is somewhat a tale of two markets, large and small. While the middle market ($50M to $500M in deal value) has remained relatively stable, mega deals ($500M in deal value and above) have dominated in terms of volume and value. The number and value of mega deals have increased year over year in 2017, while middle market deals have trended slightly behind and lower middle market deals have declined. Similar to what we reported last quarter, total deal volume in the United States...

Crowdfunding for Capital? Know the Rules.

Consider the traditional approach to securing business financing: Armed with your valuable idea, a sound business plan, and some marketing research, you strive to get an audience with some wealthy investors, perhaps angel funds, a venture capital firm, and a few investment banks. You spend a great deal of time and effort pitching to this very limited pool of capital investors, with uncertain success.

Now consider a current popular approach called crowdfunding: You pitch your valuable idea...

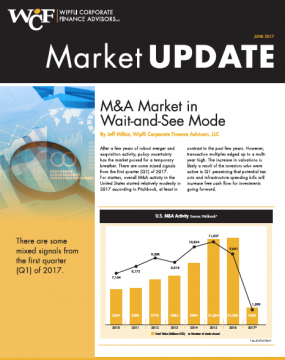

M&A Market in Wait-and-See Mode

Jun 14, 2017

|

Market Updates

After a few years of robust merger and acquisition activity, policy uncertainty has the market poised for a temporary breather. There are some mixed signals from the first quarter (Q1) of 2017. For starters, overall M&A activity in the United States started relatively modestly in 2017 according to Pitchbook, at least in contrast to the past few years. However, transaction multiples edged up to a multi-year high. The increase in valuations is likely a result of the...

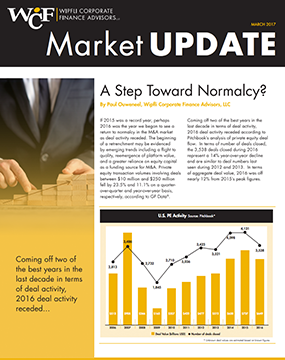

A Step Toward Normalcy?

Mar 01, 2017

|

Market Updates

If 2015 was a record year, perhaps 2016 was the year we began to see a return to normalcy in the M&A market as deal activity receded. The beginning of a retrenchment may be evidenced by emerging trends including a flight to quality, reemergence of platform value, and a greater reliance on equity capitol as a funding source for M&A. Private equity transaction volumes involving deals between $10 million and $250 million fell by 23.5% and 11.1% on a quarterover- quarter and year-over-year...

Surveying the Value of Investment Bankers

Jan 01, 2017

|

Market Insights

It’s not uncommon to encounter business owners who are selling their companies yet are hesitant to engage the help of investment bankers. Oftentimes those owners believe they can replicate the banker’s service without having to pay a fee.

In contrast, there are those owners who have engaged investment bankers to lead the sales process and found that the value they received from their advisors far outweighed the fees paid.

To be sure, there have been numerous studies that clearly bear...

Looking to be more acquisitive?

Having an acquisition plan is critical. Start yours now.

Get the checklist now

Categories

All Categories

Read all Market Updates and Insights

Market Updates

A quarterly, insightful look at middle-market merger and acquisition activity.

Market Insights

Thought-provoking articles on value, growth, and strategy, merger and acquisition news, research and analysis from WCF consultants.

Client Success Stories

See how WCF has earned our clients’ confidence with strategic and transactional support and guidance.