Market Activity Fueled by Demand, Favorable Valuations, and Lending

Please be aware: More recent data has been published since the time of this post. To see current market trends, check out the most recent issues of Market Updates.

Deal flow remained strong through the third quarter of 2014, fueled by strong transaction multiples and favorable leverage terms.

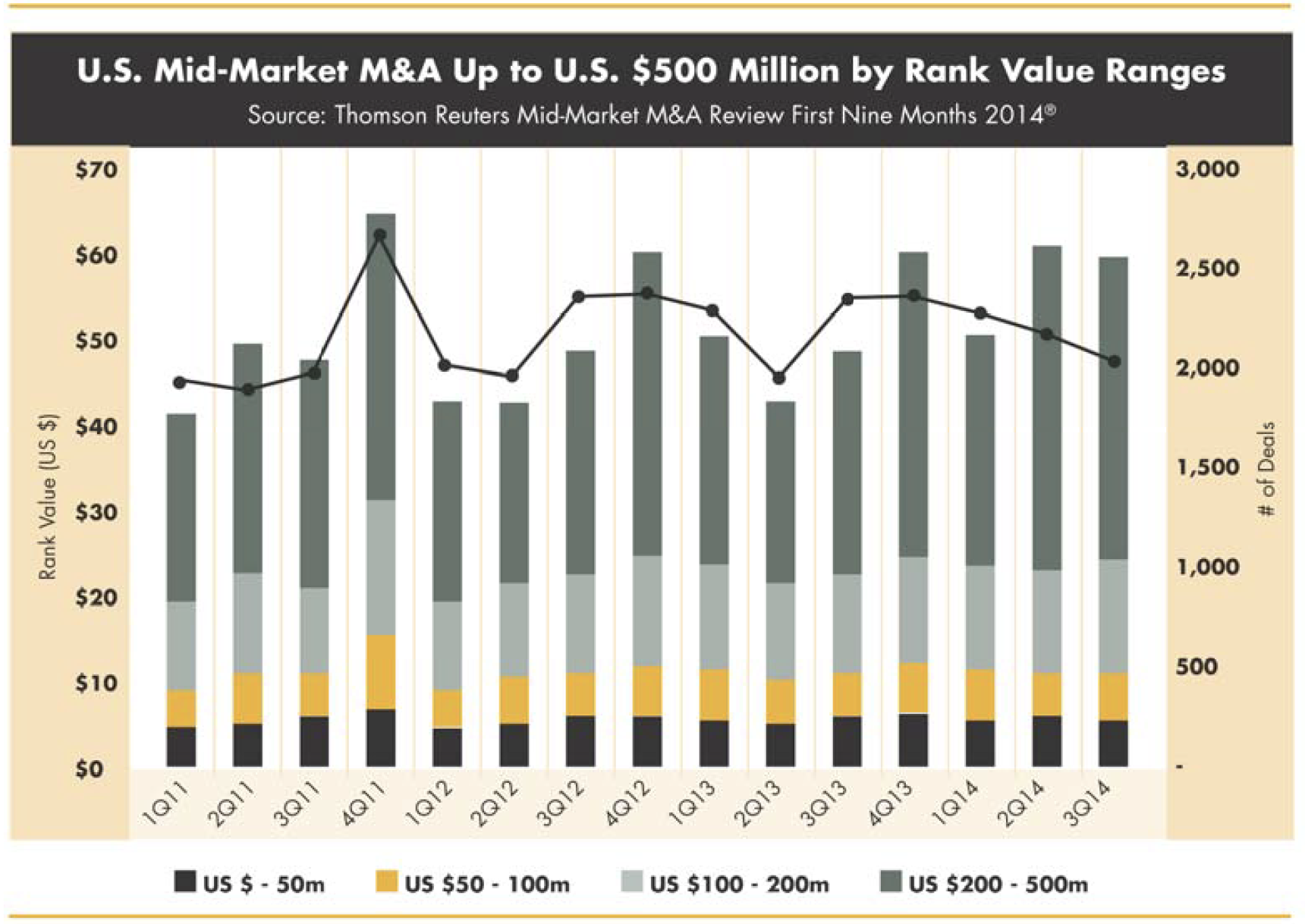

Thomson Reuters reports a 22% increase in worldwide mid-market M&A deal volume for the first nine months of 2014 over the prior year. The Americas region leads the market with $228.1 billion of announced deal activity, representing a 20.5% share of the market. Deal value has grown more than volume, supporting other reports of rising transaction multiples, particularly for larger transactions. The chart below shows both value and number of lower mid-market deals by rank value:

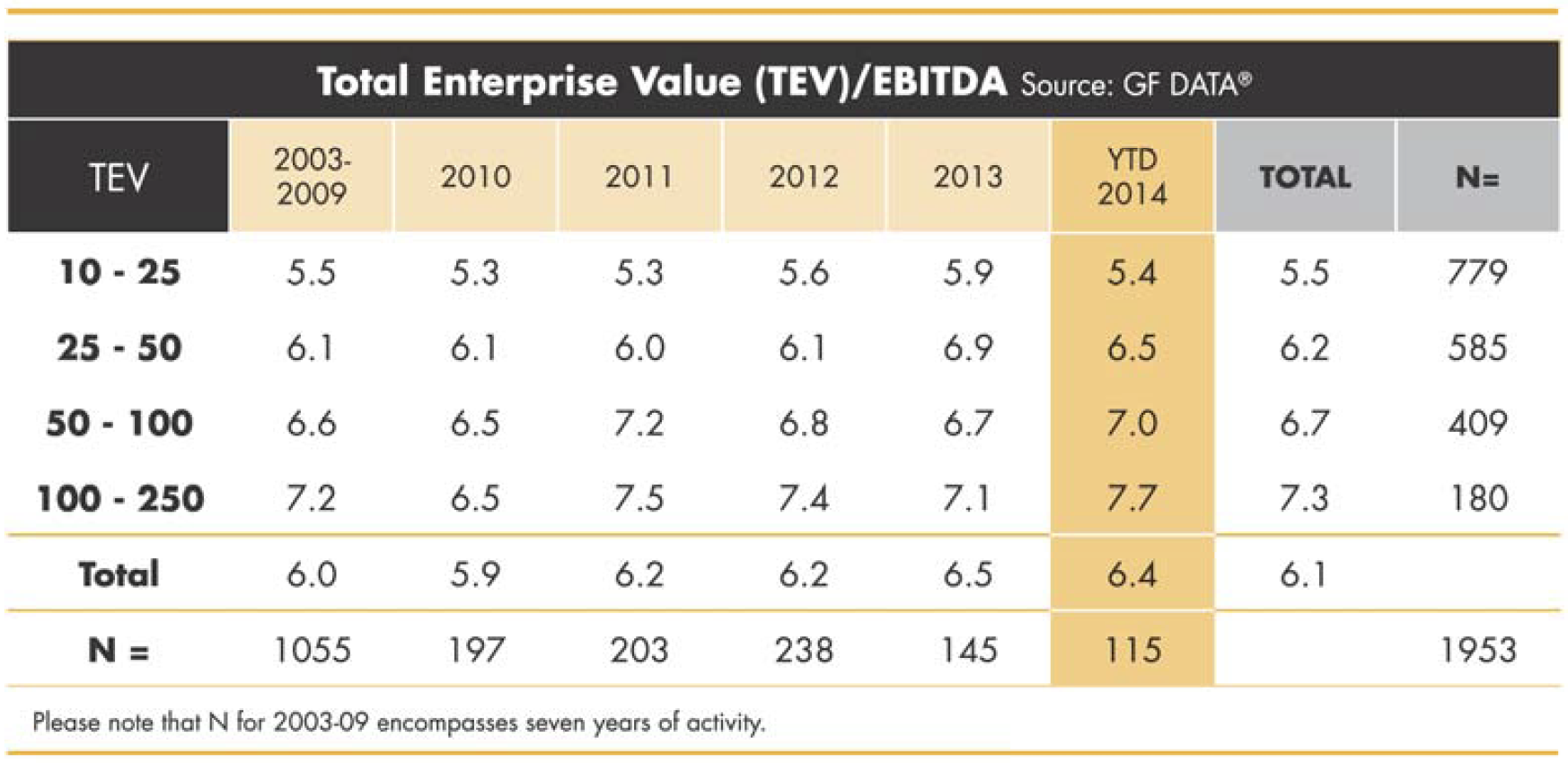

GF Data, in its November 2014 M&A Report, shows 115 transactions done by its 193 active private equity data contributors year to date in 2014.

Multiples for transactions with enterprise value $50 million to $100 million and $100 million to $250 million increased year over year. It is noteworthy that multiples in the lower tiers with total enterprise value $10 million to $25 million and $25 million to $50 million were slightly lower than the prior year, which is consistent with leverage ratios, which are fueling the overall increase in valuations for larger deals but less so at lower deal levels. GF Data's reported total enterprise value/EBITDA multiples by data and size are illustrated in the chart below.

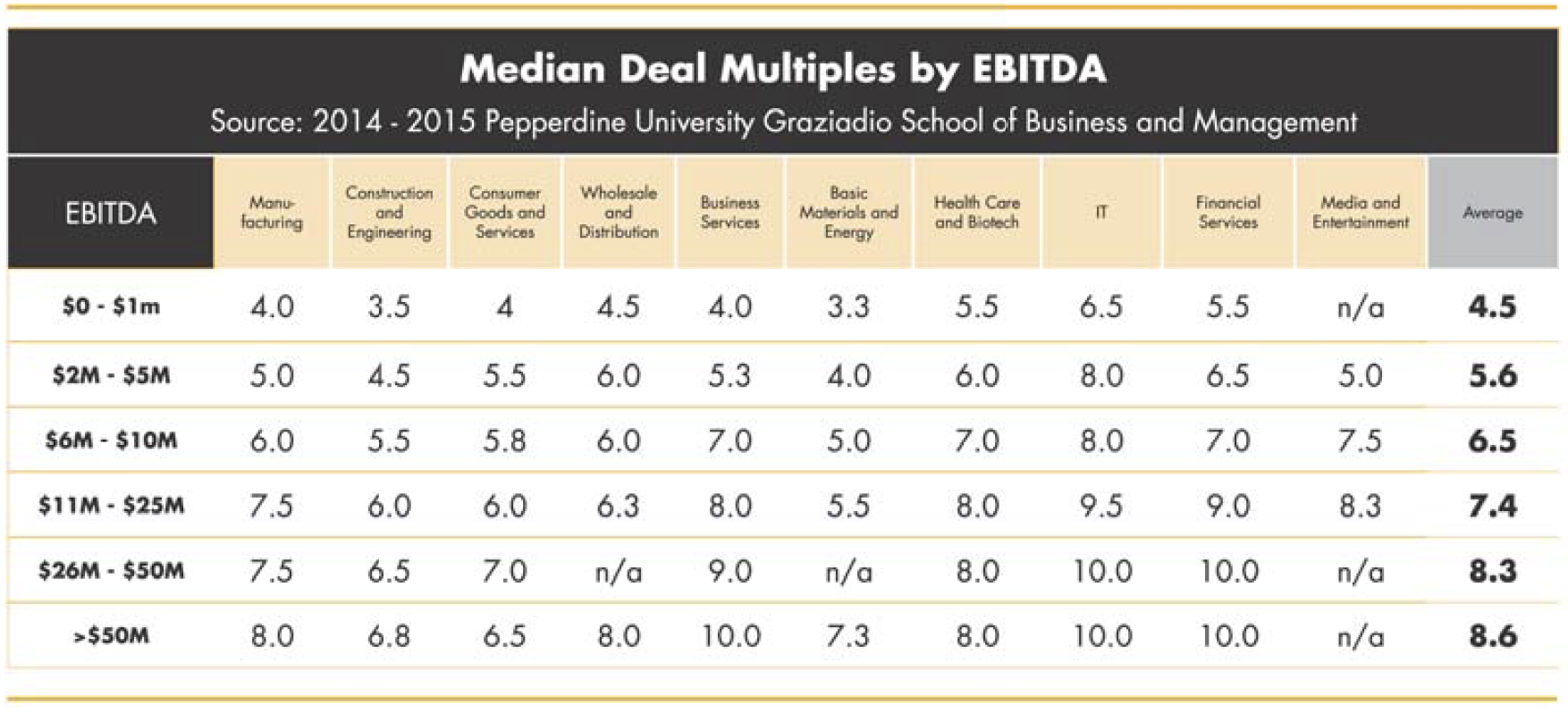

Further breakdown of multiples by size and industry is reported by Pepperdine University Graziadio School of Business and Management in their 2015 Capital Markets Report. For the 104 investment bankers reporting in their survey, deal multiples by EBITDA and industry are as follows:

At Wipfli Corporate Finance Advisors, we have seen significant increase in companies considering a sale in 2015. Fourth quarter of the year is typically "planning season" for many companies whose budgets are completed and three or five-year plans updated. Accordingly, it is not atypical for exit planning to surge in Q4; however, many discussions are taking on a more serious note. Prognosticators have been forecasting an increase in deal activity because of aging demographics for several years, but the market throughout 2014 has remained a seller's market with more buyers than qualified sellers. This trend will reverse at some point, and rising multiples, favorable lending climate, continuing economic recovery, and a strong bose of qualified buyers are pointing to a more dramatic shift in 2015.

Additionally, because of the rise in valuations, we are seeing an increased focus on data quality and due diligence. An accurate representation of normalized earnings is critical to maintaining the deal value through to closing. As part of pre-planning, sellers need to ensure they have good numbers, a compelling vision, and a forecast they are prepared to be measured against throughout the sole process. Buyers paying strategic premiums are diligent in understanding the quality of earnings pre-close.

Thoughtful M&A planning is essential to successful transactions. To ensure your transaction achieves your goals, engage an experienced M&A advisor who understands the market and can best position your transaction for success.

The content of this material should not be construed as a recommendation, offer to sell or solicitation of an offer to buy a particular security or investment strategy. The content of this material was obtained from sources believed to be reliable, but neither Wipfli Corporate Finance Advisors, LLC nor RKCA, Inc., warrants the accuracy or completeness of any information contained herein and provides no assurance that this information is, in fact, accurate. The information and data contained herein is for informational purposes only and is subject to change without notice. This material should not be considered, construed or followed as investment, tax, accounting or legal ad vice. Any opinions expressed in this material are those of the authors and do not necessarily reflect those of other employees of Wipfli Corporate Finance Advisors, LLC or RKCA, Inc. Investing in the financial markets involves the risk of loss. Past performance is not indicative of future results.

Looking to be more acquisitive?

Having an acquisition plan is critical. Start yours now.

Get the checklist now

Categories

Read all Market Updates and Insights

A quarterly, insightful look at middle-market merger and acquisition activity.

Thought-provoking articles on value, growth, and strategy, merger and acquisition news, research and analysis from WCF consultants.